Is PLM Only for the Big Guys or Can Mid-Market Manufacturers Share in the Fun?

Is product lifecycle management (PLM) a discipline that only applies to large manufacturers?

If you read the Wikipedia definition it certainly sounds that way: "In industry, product lifecycle management  (PLM) is the process of managing the entire lifecycle of a product from its conception, through design and manufacture, to service and disposal. PLM integrates people, data, processes and business systems and provides a product information backbone for companies and their extended enterprise."

(PLM) is the process of managing the entire lifecycle of a product from its conception, through design and manufacture, to service and disposal. PLM integrates people, data, processes and business systems and provides a product information backbone for companies and their extended enterprise."

PLM consultants CIMdata put their own spin on the process, defining PLM as:

-

A strategic business approach that applies a consistent set of business solutions that support the collaborative creation, management, dissemination, and use of product definition information.

-

Supporting the extended enterprise (customers, design and supply partners, etc.).

-

Spanning from concept to end of life of a product or plant.

-

Integrating people, processes, business systems, and information.

Sounds complicated. Sounds like you'll need a phalanx of people with tablets (used to be clipboards), flow charts and stop watches to put all the pieces together and watch over this vast, interconnected process that can make or break your business.

Blogging About PLM

We ran across a couple of blog posts the other day from Tim Egloff, the marketing manager at Siemens PLM Software, that shed some light on this topic. A business unit of the company's Industry Automation Division, Siemens PLM Software is the leading global provider of PLM software and services with, according to CIMdata, 63,000 customers worldwide.

We ran across a couple of blog posts the other day from Tim Egloff, the marketing manager at Siemens PLM Software, that shed some light on this topic. A business unit of the company's Industry Automation Division, Siemens PLM Software is the leading global provider of PLM software and services with, according to CIMdata, 63,000 customers worldwide.

Egloff was reflecting on a webcast he attended that addressed some of the challenges facing manufacturers — in this case the automotive industry — brought on by changing demographics, green considerations, intense competition and the need to manage the entire product lifecycle to cope with these complex issues. All of this makes for a great deal of risk and uncertainty that "...will demand greater flexibility, innovation and collaboration from the automotive industry."

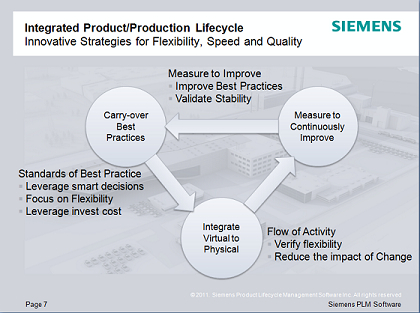

Not surprisingly, he advocates PLM along with adoption of best practices to help not just the automakers, but manufacturers in all industries. He cites three key digital manufacturing strategies that are shown in the chart below:

Egloff points out that these strategies incorporate the basic tenants of lean manufacturing — standards, flow and measurement.

He explains what it takes to achieve to achieve flexible production practices that minimize the impact on profitability and quality. In particular, Egloff contends that "By identifying your best-in-class operations in a process template defined as the bill of process (BOP), all resources, tooling, machinery and their configurations can be integrated providing the basis for streamlining carry-over of you operational assets."

Armed with this information, manufacturing planners can leverage smart decisions from previous plans, realize a higher ROI from capital equipment investments, and drive greater flexibility into the company's production capacity.

Two essential ingredients to achieve this state of manufacturing nirvana are a PLM system to cope with the complexity involved in, for example, producing the same product in multiple plants and/or multiple products in the same plant. This PLM foundation will help you identify or create the discipline and process needed to add the second ingredient — your best practices.

Says Egloff, "For manufacturers, uncertainty demands smarter decisions to balance short-term gains against long-term viability. Increasing your flexibility in manufacturing improves your position for both outcomes as long as the right strategies are in place to manage the dichotomy between rapid change and a stable production environment."

PLM for the Mid-Market Manufacturers

For all these reasons, PLM has been heartily embraced by large manufacturers around the globe. But what about smaller manufacturers that lack the internal resources of a Boeing or General Motors?

In our excursions around the Web looking for background on PLM as it applies to mid-market manufacturing companies, we ran across an interesting blogger, a "Virtual Dutchman" by the name of Jos Voskuil. He's a business consultant helping mid-market companies implement PLM using a stepped approach. Last year he published a blog titled "Mid-market deadlocks for PLM," which sums up the situation rather nicely.

Rather than defining a mid-market company in terms of revenue or number of employees, Voskuil characterizes them as businesses where everyone is focused on the company's primary process. There is no strategic layer of people devoted to analyzing current business and planning for the future. The company is primarily in a reactive mode, which, like a frog slowly boiling in a pot, can lead to problems in the long term. Also, when it comes to implementing PLM, these mid-sized organizations have a minimal and usually overworked IT staff that is regarded more as overhead and less as a strategic asset.

Concludes Voskuil, "Although I am aware that many mid-market companies implement basics of PLM, it is frustrating to see that lack of priority and understanding of the management in mid-market companies blocks the growth to full benefits for PLM. The management is not to blame, as most PLM messages either come from the high-end PLM vendors or from product resellers both not packaged for the mid-market."

A Few Examples

Despite the hurdles, there are a number of vendors who have fielded PLM packages specifically tailored to the mid-market.

For example, Siemens offers its Velocity Series that consists of a series of separate but integrated modules designed to provide a great deal of PLM functionality with a low total cost of ownership. The Teamcenter Express module is touted as an easy-to-use, easy-to-deploy collaborative product development management solution. It supplies preconfigured best practices to everyday engineering tasks. The module manages the complete design process for engineering organizations being inundated by data because of the growing complexity of their products.

Other modules in the Velocity Series include Solid Edge, a 2D/3D CAD system complete with a full range of modeling and assembly tools; Femap software, a CAD-neutral advanced engineering analysis environment; and CAM Express, a numerical control programming application designed to meet key machining requirements.

From Dassault Systemes comes V6 PLM Express specifically tailored for the mid-market. The software embodies the values articulated by Dassault in its definition of PLM 2.0, including: 3D CAD and virtualization; real-time, seamless collaboration; direct on-line access to actual data; design-anywhere functionality; and a single scalable platform.

The Dassault package includes a variety of modules such as: Shape Designer, an industrial design solution for styling and design; Mechanical Engineer, which includes process-oriented modeling, tolerancing and kinematic tools; Equipment Engineer for process oriented, collaborative solutions; Machining Engineer consisting of manufacturing solutions and tools that are integrated with the design environment; and Robotics Engineers, used for programming robotic material handling and arc welding systems.

There are many other excellent PLM vendors out there and many of them have adapted their software to meet the mid-market requirements for a streamlined, easy-to-use, preconfigured modular system that doesn't break the bank when it comes to licensing and support.

Note that in a recent report from IDC Manufacturing Insights, the research firm ranked Siemens PLM and Dassault Systemes as the PLM leaders in the discrete manufacturing industries market.

Other PLM vendors include such notables as SAP, Oracle, Autodesk, Microsoft, IBM, PTC, and Aras. Aras is interesting because it is the only company offering a PLM solution based on an open-source business model powered by model-based SOA technology. Their approach is attractive to mid-market companies because open source means no licensing which eliminates up-front expenses and per user costs.

So in response to our initial question — is PLM a discipline that only applies to large manufacturers? – the answer is a resounding no!

There are numerous PLM solutions available today that directly address mid-market manufacturers seeking to streamline their operations, boost profitability, and compete in broader markets. However, for some of these manufacturers engaged in a ceaselessly struggle to survive and prosper, taking the long, strategic view that implementing PLM implies may be difficult indeed — but you must admit, it's better than being a frog in the pot.

There are numerous PLM solutions available today that directly address mid-market manufacturers seeking to streamline their operations, boost profitability, and compete in broader markets. However, for some of these manufacturers engaged in a ceaselessly struggle to survive and prosper, taking the long, strategic view that implementing PLM implies may be difficult indeed — but you must admit, it's better than being a frog in the pot.