Bellwether Intel Says Enterprise IT Spending on the Upswing

Sales of processors and other components into the enterprise market have not panned out as expected for Intel in the past three years, the company admitted at its industry analyst meeting late last week, However, other markets that buy chips, chipsets, and other components from its Datacenter and Connected Systems Group helped fill in some of the gaps, allowing Intel to gain market share.

More significantly, Diane Bryant, general manager of the datacenter group at the chip maker, said that the company was projecting for spending among enterprises to resume their normal growth pattern, and in fact has seen an uptick in spending in the second half of 2013 already.

Back in the fall of 2011, when Kirk Skaugen was general manager of the Datacenter Group, he said that it took ten years for Intel to double its processor and chipset business related to servers, storage, and networking to $10 billion between 2000 and 2010. The plan, given a rapid expansion in storage and a big push into networking was to double it again to $20 billion in half the time – by 2015. A few months later at a similar analyst day as the one held last week at the company's headquarters, Intel put out a slightly different forecast, projecting growth by market segments product segments between 2011 and 2016. Below is that forecast as well as a comparison to the growth that Intel has seen in the past three years from 2011 to what it expects for the end of 2013. Bryant is grading how well or poorly Intel made its projections:

The good news for Intel is that it exceeded its projections for sales of chippery into the cloud and high performance computing performance computing markets and hit its targets for sales into telecommunications companies and other service providers. (Intel sells into these markets indirectly through channel partners and OEMs, with the exception of the very largest cloud builders and Web application providers, who have their own direct relationships with Intel.)

"Where we didn't hit is pretty clear," said Bryant in her presentation at the analyst meeting. "The enterprise IT segment just did not grow as expected. In fact, the market has actually contracted over that period."

You can blame the global economy, Bryant explained. And in particular, estimates for gross domestic product increases and decreases as they reflect the regional, national, and global economy and affect the behaviors of CEOs and CIOs the world over.

"The biggest driver of IT growth is GDP," said Bryant. "As Intel's CIO for four years, I know that as a fact and our CFO never hesitated to pull my budget when the economy was hitting a lull."

Bryant added that enterprise datacenters had been in the midst of a server upgrade cycle that started in 2010 and accelerated in 2011 that was brought about server virtualization initiatives. Most companies do a hardware upgrade to get the latest-greatest virtualization support and the higher core counts and memory capacity that comes from the shiniest iron. So there was a nice bump in sales when Intel made its projections back in 2010 and 2011, and that upgrade cycle is largely over.

Bryant added that enterprise datacenters had been in the midst of a server upgrade cycle that started in 2010 and accelerated in 2011 that was brought about server virtualization initiatives. Most companies do a hardware upgrade to get the latest-greatest virtualization support and the higher core counts and memory capacity that comes from the shiniest iron. So there was a nice bump in sales when Intel made its projections back in 2010 and 2011, and that upgrade cycle is largely over.

Before this virtualization bubble and before the GDP slowdown, sales of Intel chips into products that went into enterprise datacenters was growing at a compound annual growth rate of around 8 percent. The virtualization bubble pushed it up to around 13 percent, and between 2011 and 2013 it has actually contracted by 1 percent per year.

The net-net is that instead of having 15 percent growth in the past two years in its datacenter business, it has seen something on the order of 8 percent. This is better than the growth in the server, switch, and storage markets at large, but it is still less than plan.

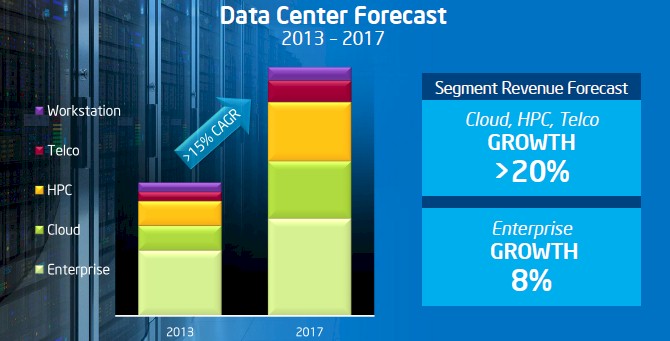

Looking ahead into the period from 2013 through 2017, Intel is now projecting that its revenues in the cloud, HPC, and telco markets will grow by more than 20 percent (that's a compound annual growth rate) and that sales into enterprises will rise by around 8 percent, the same rate as before the GDP slowdown and the virtualization boom.

"We believe that enterprise IT will recover, and we are seeing signs of that in the second half of this year," said Bryant. That 8 percent growth in the enterprise part of the Intel datacenter business is based on sever volume projections from the big IT analysts married to Intel's own projections for rising average selling prices for the chips it peddles into this market.

Add it up, and the datacenter business in the aggregate should grow at more than 15 percent over that term. If you do the math, as EnterpriseTech has done, what this means is that it will take Intel an extra year or so to break through the $20 billion barrier for its Datacenter and Connected Systems business.

This is not exactly a crisis.

Intel has come to rely on sales to the hyperscale datacenter operators, many of whom now get custom processors from the company. Bryant said that six of the seven biggest hyperscale sites have opted for CPUs higher up in the product line, offering more performance, with the past two generations of Xeon processors. This is pushing up revenues as is the sheer number of machines these companies put into the field. These cloud companies are also early adopters of other technologies, and Bryant mentioned 10 Gb/sec Ethernet networking and solid state drives as two examples. Intel has deep relationships with the top seven of these hyperscale companies and has direct relationships with the top forty in the world.

Because of the volumes that these hyperscale companies buy at, they can demand special treatment from Intel and get it. eBay, for instance, has its own homegrown cooling systems for its servers and datacenters, which allows for it to run chips at higher clock speeds. In this case, eBay has special chips from Intel that offer a 50 percent performance boost compared to standard parts. And Facebook has been able to get two special low-power CPUs for its cold storage facility, which EnterpriseTech told you about last month. Nuance is working with Intel to get special CPUs that have accelerators to boost voice recognition software performance. And others will no doubt follow.

The other trend that Intel sees as pushing its datacenter business is the move from public clouds to private clouds. Yes, that sounds backwards, but it is not. The poster child for this move is online game provider Zynga, which used to run its infrastructure on a public cloud but shifted to its own private cloud. Why? Because at a certain scale, the cost per virtual machine is 50 percent lower on an internal cloud than running it on a public cloud. The different is whatever margin companies like Amazon make on their clouds. And provided a company has the talent and the capital to build and run its own infrastructure, it makes sense to do so.