Gartner Trims Forecasts, But IT Budget Growth Still Good

The first thing anyone wants to know when the new year kicks off is will this one be better than the last one. You can't know this ahead of time, of course. The only way to be sure is to live through the year. But, prognosticators are paid to make their predictions and thereby give us some data with which to make our decisions.

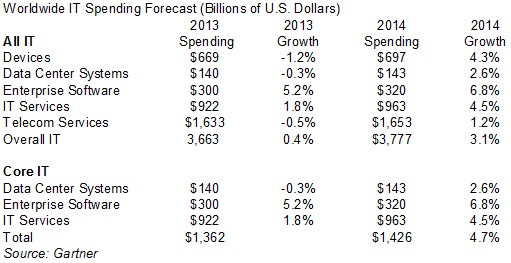

The wizards at Gartner polished up their crystal ball and after gazing into it a bit, they reckon that IT spending will rise more in 2014 than it did in 2013. However, Gartner is revising its IT spending forecast downward, having thought previously that some parts of the IT business would do better this year than the company thought a few months ago when it did its initial projections. Back then, Gartner was expecting for 2014 IT spending, as counted in US dollars, would rise by 3.6 percent, but it has just pulled that back to a 3.1 percent bump.

Gartner calculates that last year global IT spending rose by a mere four-tenths of a percent to $3.66 trillion. This 2013 estimate will very likely be tweaked a bit once the financial results of all of the major IT players come out in the next few months. Spending on various kinds of end user devices were off 1.2 percent last year as spending on PCs declined, and this drove down the overall IT spending number, as you can see in the chart below. The upsurge in spending on tablets and smartphones was not enough to offset the PC drop.

It is hard to tell the difference between a consumer and a corporate end user device anymore, so Gartner does not even try. Ditto for telecom services. Both of these segments aggregate consumer and corporate data together. And because EnterpriseTech is focused on the datacenter, we teased out the three key IT segments – datacenter systems, enterprise software, and IT services – and added these up.

As you can see, datacenter systems spending, which includes servers, storage, and switching gear, was a little soft last year, down three-tenths of a percent. Gartner is projecting a modest 2.6 percent increase in spending in this area for 2014, and that is down from a 2.9 percent growth projection a few months ago. Gartner now anticipates that sales of storage arrays with their own controllers will be lower, and said that various enterprise communications programs that are sold with hardware will also be cut back.

IT services spending is also expected to accelerate this year, rising by 4.5 percent. Gartner has just cut back its projections in this area, too, due to expected changes in IT outsourcing habits as companies shift from co-location in hosting providers to cloud computing. "We are seeing CIOs increasingly reconsidering datacenter build-out and instead planning faster-than-expected moves to cloud computing," explained Richard Gordon, managing vice president at Gartner, in a statement announcing the spending forecast. "Despite these small reductions, we continue to anticipate consistent four to five percent annual growth through 2017."

For the past several years, enterprise software spending has been the bright spot when it comes to growth, and in 2014 this category will grow more than twice as fast as datacenter hardware spending and will end up being a market that is twice as large as 2014 comes to a close. Gartner says that customer relationship management and supply chain management were the fastest-growing parts of the enterprise software market.

"Investment is coming from exploiting analytics to make B2C processes more efficient and improve customer marketing efforts. Investment will also be aligned to B2B analytics, particularly in the SCM space, where annual spending is expected to grow 10.6 percent in 2014," said explained Richard Gordon, managing vice president at Gartner, in a statement announcing the spending forecast. "The focus is on enhancing the customer experience throughout the presales, sales and post sales processes."

Telecom services, which accounts for around 40 percent of total worldwide IT spending as Gartner counts it, will not grow as much as Gartner originally expected in 2014 for a number of reasons. First, more people are cutting the cord and getting rid of wired telephones. Customers are getting more savvy about their phone plans, too, and price competition to keep customers and find new ones is also putting pressures on revenues.