HP Will Chase IBM Accounts To Grow Datacenter Biz

Sales of servers, storage, switching, software, and services at Hewlett-Packard's Enterprise Group were up a smidgen in its most recent quarter, but like its peers in the IT space, HP is having trouble boosting its profits in this area because of intense competition. The decision by IBM to sell off its X86 server business to Lenovo gives HP an opportunity, say the company's top executives.

In the first quarter of fiscal 2014 ended in January, HP booked total sales of $28.15 billion, down seven-tenths of a point from the year-ago period. After some stringent cost controlling, HP was able to boost net income by 15.7 percent to $1.43 billion, and that was after booking $114 million in restructuring charges relating to the layoff of 34,000 employees that has been underway since last year. In the Enterprise Group, sales were up by the same seven-tenths of a point as the company overall, to a tad under $7 billion, but operating income for this group fell by 6 percent to just over $1 billion.

HP's Itanium-based Business Critical Systems division continues to shrink and is now at under a $1 billion run rate, with only $228 million in sales and falling 25.5 percent year-on-year. The BCS unit also includes sales of quad-socket Xeon E7-based machines and will also be where sales of future "Project Odyssey" machines, which will span up to sixteen sockets, get booked. HP is in the middle of a transition from its HP-UX systems on Itanium to Xeon E7 machines running Windows and Linux for this top-end of its customer base.

While HP plans to keep HP-UX and OpenVMS operating systems available until at least 2020, and currently does not have plans to port either to Xeon machinery. The company is, however, working on a port of the NonStop fault tolerant operating system and database from Itanium to Xeon machinery. Intel and HP are working together on a "Kittson" kicker to the current quad-core Itanium 9500 processors, but Intel doesn't say when to expect this chip to come to the field. The expectation in the market is that Kittson will be the last Itanium chip, and it will not be a true kicker to the current "Poulson" Itaniums as was originally planned but rather a tweak of the existing Poulson design. This is not a surprise, given the falling sales of Itanium-based systems at HP, which accounts for the lion's share of Itanium sales worldwide. The irony is that given the scale-out nature of NonStop clusters, which can scale to 4,080 nodes, NonStop machines need an in-node performance boost less than customers running HP-UX workloads on big NUMA systems. HP's techies planned several different ports of HP-UX to Xeon processors, but they were never funded. It is amazing that HP bought Autonomy instead of Red Hat, given all of this.

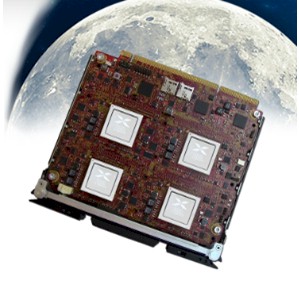

A few quarters ago, HP's Industry Standard Servers division, which designs and sells its ProLiant X86 servers using Xeon E3 and E5 and Opteron 4300 and 6300 processors, saw revenues slipping, but in the fiscal first quarter, sales were up 6.2 percent $3.18 billion. HP CEO Meg Whitman said on a conference call with Wall Street analysts that the company had another strong quarter for sales of customized machines for hyperscale datacenters, but conceded that this "contributes to pressure margins." She said that HP was making progress with the Moonshot hyperscale machines, which are aimed more at enterprise customers than other custom machines that HP makes for the likes of Microsoft for its monster datacenters. Whitman said that, with regard to Moonshot, that "interest remains high" and that HP is working with a number of customers on proofs of concept. How many customers, she did not say.

On the storage front, HP's sales were flat at $834 million, and this is relatively good news when you consider that sales of legacy storage arrays fell by 17 percent to $490 million. Sales of converged arrays, including 3PAR machines and their various software add-ons, rose by 42 percent to $344 million in the quarter. Whitman said that 3PAR is doing particularly well among midrange customers. HP's networking business was up 4 percent to $630 million, and sales of switches rose by 5 percent and did much better than switching juggernaut Cisco Systems did in the comparable period. Finally, the Technology Services division, which provides tech support for all of this gear, had $2.12 billion in sales, down 4 percent as reported but only off 2 percent at constant currency.

HP Software had a 4 percent decline, to $916 million, in the quarter, and operating profits fell faster at 6.5 percent to $145 million. Sales at the Enterprise Services group, which does systems integration, outsourcing, and cloud computing, fell by 7 percent to $5.6 billion; earnings in this group fell by 25 percent to a razor-thin $57 million. HP was able to show growth in its PC business, up 3.6 percent to $8.53 billion, and operating earnings were up 19.7 percent to $279 million. Margins in HP's printing businesses were up 1.2 percent to $979 million on revenues of $5.82 billion, down 2.2 percent.

There are only two reasons why the PC and printer businesses matter to enterprise datacenters. If HP is not worried about dropping PC sales and is making a little money there, then it will continue to stay in the business and will be able to use its leverage with Intel and AMD to get good pricing on chips used in servers, storage arrays, and network devices. And any margins it makes in printers means HP can be less concerned about trying to wring profits out of enterprise customers.

Whitman said that HP was not particularly concerned about IBM selling off its X86 server business to Lenovo, either. This deal will probably get done a few quarters from now, and Whitman said that any big deal like this creates uncertainty about the continuity of roadmaps, investments, and commitment to customers and was therefore an opportunity for HP's server business to get into datacenters and sell against IBM.

This, of course, is something that System x general manager Adalio Sanchez told EnterpriseTech was not an issue because Lenovo is absorbing the entire System x product line and the engineering, sales, and marketing teams behind them. Moreover, Big Blue is providing support for System x machines for at least five years until Lenovo builds its own support organization.

No matter who is right over the short term, Whitman is not underestimating Lenovo, particularly after the Chinese company has become the dominant PC shipper, knocking HP off as king of the hill.

"I think we have a near-term opportunity here to gain share in our enterprise services or in our server business," Whitman said. "So we are all over it. We will be all over it with our channel partners, and I think there's a good near-term opportunity. In the long term, obviously, Lenovo is going to be a powerful competitor and we aim to be well set up by the time the deal is done to compete really aggressively."