Quanta Pushes Foot Inside Enterprise Datacenter Doors

Hyperscale cloud operators like Facebook and Rackspace Hosting came to Taiwanese manufacturer Quanta Computer several years ago when they wanted to design and build custom machines tuned up for their specific workloads. Quanta Cloud Technology, the server and storage sales arm of the $34 billion company, is looking to repeat the success it has had among cloud service providers by creating products aimed at the high-end of the enterprise market. And based on early results, Quanta's strategy is working.

Mike Yang, general manager of the Quanta QCT subsidiary, took some time to talk to EnterpriseTech about how business is going and how it expects to make headway into enterprise datacenters that have long since been the turf of IBM, Hewlett-Packard, Dell, Oracle, and a handful of others.

The Quanta QCT subsidiary was established in May 2012 in Freemont, California, which is a hotbed of IT product engineering and manufacturing, with the express purpose of selling Quanta's home-designed rack systems and storage to North American organizations. By setting up in Freemont, Quanta could get closer to some of its largest buyers and also expand its customer footprint more easily. Quanta has been a big proponent of the Open Compute Project, which was started by Facebook in April 2011 to open source the social network's own server, storage, rack, and datacenter designs. Last October, Quanta QCT started selling OCP-compliant machinery to customers in the United States and Canada.

If Quanta Computer wants to grow its server business, it is going to have to rely on Quanta QCT to make headway into enterprise datacenters in North America and Europe. Cloud service providers buy servers in lots of 5,000 or 10,000 comprise somewhere around 20 percent of the server market today, give or take depending on who you ask. There are only dozens – not tens of thousands – of such customers. Yang expects for hyperscale datacenter operators and cloud service providers to continue to build out their infrastructure like crazy, but also expects for strong uptake in the enterprise.

"Three years from now, I am expecting for cloud service providers to have maybe optimistically 40 percent of worldwide server shipments," Yang explains to EnterpriseTech. "Of the remaining 60 percent, the majority should be the enterprise market. There will still be HPC centers and other segments that are not in the enterprise. I think that when you talk about hyperscale datacenters, we do have the major share in that space. As for enterprises, we will be focusing on forward-thinking enterprise customers that are adopting private or hybrid clouds. This is something that is new to us, but we would like to create more in this space."

Enterprises have long refresh cycles for servers and storage arrays, and they have to do their due diligence to investigate the supply chains behind these new system suppliers – not just Quanta QCT, but also companies such as AMAX, Avnet, Hyve Solutions, Penguin Computing, Rackline, and WiWynn. (The latter company is a spinoff of Taiwanese ODM Wistron, which is about two-thirds the size of Quanta Computer.) Enterprises have to be comfortable with the warranties on the components that go into the systems as well as the overall systems, and they have to be sure that when they need machinery their partners can manufacture, integrate, and deliver it in a timely fashion.

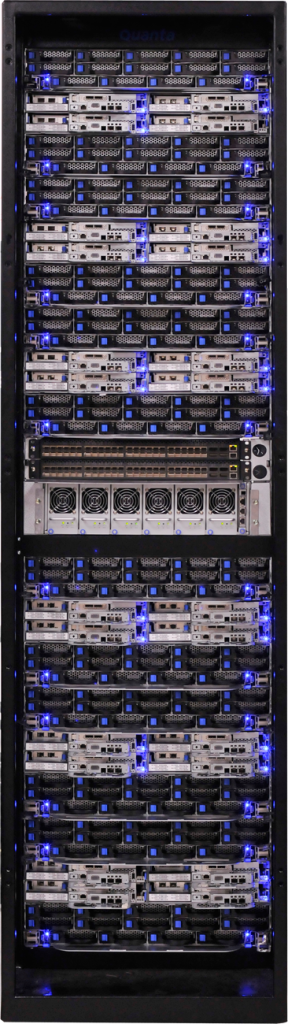

"For the enterprise market, our growth highly depends on how fast they move into private clouds and hybrid clouds," continues Yang. "Starting from the second half of last year, we invested a lot, particularly with software integration. So we are talking with VMware, we are talking with Red Hat and others for OpenStack, and so forth. We want to be prepared for the private cloud and the hybrid cloud. Cloud consulting companies, such as CloudScaling, Metacloud, Piston Cloud Computing, have the OpenStack software but they do not have the hardware and rack integration. We would like to provide the gear to this market. That's why we want to increase the number of building blocks for our rack solutions."

Quanta QCT has to increase its building block count for servers, storage, and switching for another reason. One size definitely does not fit all in enterprise datacenters. While the Facebooks and Googles of the world have large and complex infrastructure, they do not have a wide variety of workloads. They have perhaps dozens of different workloads, depending on how you want to slice it, while the typical large enterprise has hundreds to thousands of different applications – perhaps 3,000 to 4,000 on average for very large enterprises – with their own compute, storage, and networking needs.

Yang cautions that not everyone is going to get the kind of customized hardware that the largest cloud service providers can command; such customization is not necessarily economical for Quanta or the customer at a moderate scale of production. "Three years from now, the majority of the customization will be for the top four or five providers only," says Yang. "For the rest, small modifications can be done."

In some cases, customers will want modifications to Quanta's own Stratos servers, Mesos storage arrays, QuantaMesh networking, or Rackgo X rack systems. In others, they might want to tweak OCP designs, much as Rackspace Hosting has done for its most recent datacenter outside London or just like big banks Goldman Sachs and Fidelity Investments are doing as they build out their private clouds. As an example of a broadened product line aimed at enterprise customers, Yang says that Quanta's engineers have just put together a four-socket Xeon server for OCP racks. This machine is for customers who want machines with higher memory capacity and core counts for virtualization and sometimes database workloads.

The interest in Quanta QCT is high, says Yang. The number of inquiries from customers during the first two months of 2013 is already five times as high as it was throughout all of 2012. This was no doubt helped by the uptake by early adopters of OCP iron outside of Facebook such as at Rackspace, Goldman Sachs, and Fidelity Investments.

The question that everybody wants to answer – especially all of the incumbents in the system, storage, and networking markets that sell into datacenters – is this: Will Quanta QCT become a vendor that enterprises in North America and Europe will become comfortable buying their gear from after decades of relationships with IBM, HP, Dell, and others?

"I think, just give us another year," says Yang, adding with a laugh that some customers have only just now figured out that the company sells switches even after they have been on the market for a while. "Because of our unique position, in that we do have servers, storage, and switches and that we do work with nearly all of the tier one cloud service providers, I think we are in very good shape. We also have design engineers and we do manufacturing and rack integration and performance tuning. I think Quanta is in a unique position in that we provide one-stop shopping. Most of the cloud service providers and enterprise customers do not know much about these things that I just mentioned. So they should just choose one throat to choke."

That, ironically, is precisely how the tier one server makers have sold their iron all these years, even when they stopped doing some of the design and manufacturing.

The appeal of Quanta is not just among enterprises, but also at supercomputing centers, you might be surprised to learn. (Or, maybe not.) Yang says that Quanta QCT has at least ten proofs of concept running on its hardware at large enterprises in North America that he can think of off the top of his head, and adds that the company also has a few test systems up and running at academic and national lab supercomputing centers. Yang was not at liberty to divulge where these test systems were running, but he did confirm that some of the tests are at national labs located in the United States.

Quanta Computer is located in Taipei, Taiwan and makes its motherboards and bare-bones systems in a factory in Shanghai, China. Rack integration is done in Shanghai for parts of Asia, and rack integration is done in Freemont for the western United States and Canada, with separate operations in Singapore and Japan for other parts of the Asian market. Quanta had a rack integration facility in Athens, Greece that is in the process of being moved to another location, with Dublin, Ireland being a possibility. Quanta is also opening up a fulfillment center and rack integration facility in Nashville, Tennessee that will service the eastern United States and Canada when it opens in the second quarter of this year.

Quanta Computer is the world's largest manufacturer of laptop computers, but what you may not know is that about one in seven of the servers sold in 2012 were either manufactured by Quanta or had one of its motherboards inside of it. This is a stunning statistic for a company that many IT shops have never heard of.

The plan, as Yang explained it a year ago, was to grow total server node counts by around 10 percent to over 1.3 million units in 2013, and that was after 19 percent growth in 2012 to 1.2 million nodes. Direct sales accounted for 34 percent of server revenues in 2011, compared to 66 percent for original design manufacturing, or ODM, sales. (ODM is the designation for when a system seller comes to Quanta to get them to help design and manufacture the machines as opposed to doing it themselves. It has more collaboration involved than a typical original equipment manufacturing, or OEM, arrangement.) Direct sales to customers worldwide more than doubled in 2012 and were expected to double again in 2013. Direct sales of systems were expected to account for 85 percent of revenues compared to 15 percent for ODM sales last year.

Quanta does not break out revenues by product line, but Yang confirmed last year that it had a run rate of many billions of dollars in sales worldwide for custom and OCP gear as 2012 was ending. The plan was for 50 percent revenue growth for servers in 2013, which is impressive in a global server market that is flat to down. EnterpriseTech estimates that Quanta's systems business could have been generating $3 billion to $4 billion in sales in 2012 – and amazingly, with only dozens of buyers. This is on par with sales at Amazon Web Services or the Power Systems or System z mainframe businesses at IBM or the ProLiant server business at Hewlett-Packard, just to put that into perspective. Now, Quanta wants to move beyond dozens of buyers to someday hundreds or even thousands.