ARM Holdings Reports Financial Results

ARM Holdings has announced its unaudited financial results for the second quarter and half year ended 30 June 2014.

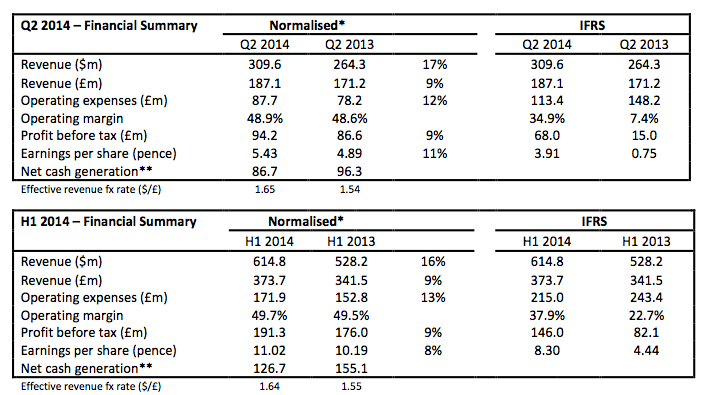

Q2 financial summary

- Group revenues in US$ up 17% year-on-year (£ revenues up 9% year-on-year)

- Processor licensing revenue in US$ up 42% year-on-year

- Processor royalty revenue in US$ up 2% year-on-year

- Normalised profit before tax and earnings per share up 9% and 11% year-on-year respectively

- Net cash generation of £86.7m

- Interim dividend increased by 20%

Progress on key growth drivers in Q2

Growth in adoption of ARM technology

-- 41 processor licences signed across our target markets of mobile computing, consumer electronics and embedded intelligent devices, taking the cumulative number of licences signed to more than 1,100

-- 7 ARMv8-A processor licences signed, including lead licences for next generation designs

-- 8 Mali multimedia processor licences signed, including first licences for video and display processors

Growth in shipments of chips based on ARM processor technology

-- 2.7 billion ARM-based chips shipped, up 11% year-on-year

-- Shipment growth especially strong in enterprise networking and microcontrollers

Outlook

ARM enters the second half of the year with a healthy pipeline of opportunities that is expected to both underpin continued strong licence revenue and give rise to an increase in the level of backlog. Market data indicates improving semiconductor industry conditions, leading to the expectation of an acceleration in royalty revenue growth in H2 2014. Given these dynamics, we expect Group dollar revenues for full year 2014 to be in line with market expectations.

Simon Segars, Chief Executive Officer, said, “Our continued strong licensing performance reflects the intent of existing and new customers to base more of their future products on ARM technology. The 41 processor licences signed in Q2 were driven by demand for ARM technology in smart mobile devices, consumer electronics and embedded computing chips for the Internet of Things, and include further licences for ARMv8-A and Mali processor technology. This bodes well for growth in ARM’s medium and long term royalty revenues.

As expected, our royalty revenue in Q2 2014 has been impacted by seasonal trends and inventory management in parts of the electronics supply chain. An improving market environment in the second half gives us confidence in strengthening royalty revenue in H2 2014."