IBM Forging Bigger Power8 Systems, Adding FPGA Acceleration

IBM launched its first servers based on the Power8 processors back in April, and the initial machines were aimed at scale-out clusters as well as at customers needing a modest standalone machine with one or two processor sockets to run their workloads. Big Blue was expected to focus initially on these scale-out machines, and was pretty vague about its plans for larger systems that gang up many more processors and larger memory footprints to go along with it.

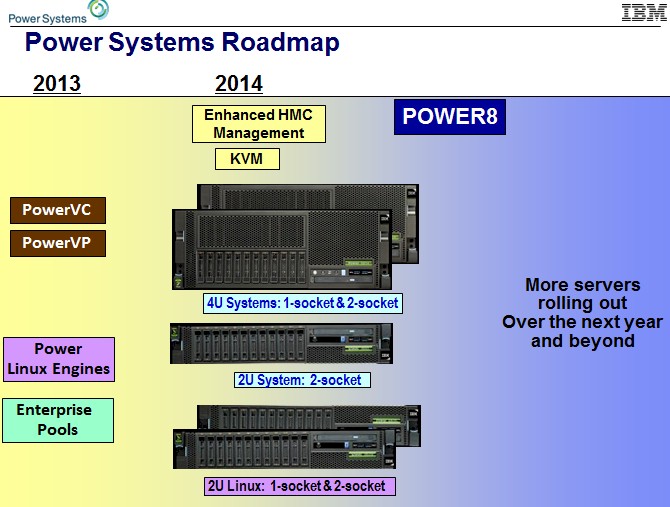

The word on the street just after the Power8 machines were launched in April was to not expect much in the way of follow-on systems, in fact, and this impression was backed up by a roadmap for the Power Systems line that IBM was sharing with partners and customers, which EnterpriseTech has managed to get ahold of. As you can see, the roadmap looking ahead from the initial April launch was empty except for the phrase "More servers rolling out Over the next year and beyond" and that was not terribly specific about what the plan is.

In going over IBM's financial results for the second quarter, Martin Schroeter, IBM’s chief financial officer, said that the Power Systems business actually saw growth sequentially from the first quarter to the second, the first sign of improvement in a long while for the Power-based server business that used to be considerably larger than it currently is. Some of the initial Power8 machines only started shipping in early June, and one model won't ship until August, so the ramp up of the scale-out machines will probably take some time. July and August are not usually hot times for big server acquisitions; that happens between September and December, historically. And if there is pent-up demand for Power8 machines, sales should rise throughout the year on a sequential basis.

That said, IBM could – and probably will – show year-on-year declines in the quarters through 2014 as the Power Systems business finds a new level from which to build. The decline might not be as severe as the 28 percent seen in the second quarter, particularly if IBM has midrange and high-end machines shipping before the end of the year. Schroeter was not specific about the details, but said on the call with Wall Street that the Power8 chip will be "introduced into midrange and high-end segments over the remainder of the year." This is perhaps a bit sooner than many had expected, but absolutely consistent with the past rollouts of Power chips into the Power Systems line.

The Power Systems business will probably never rise to the $5 billion annual run rate it once enjoyed when the Unix systems business overall was doing better and when IBM was taking share away from Hewlett-Packard and Sun Microsystems (and then Oracle after it ate Sun). But that does not mean IBM cannot turn a buck selling Power-based systems to the several hundred thousand customers it has using Power iron to run AIX, Linux, and IBM i (formerly OS/400) workloads. IBM has trimmed back its personnel in the Power Systems division to get its costs in line with revenues and is now trying to expand the reach of Power processors into new markets through the OpenPower Foundation and other efforts, such as pitching Power8 machines as a better alternative to X86 iron for high frequency trading.

IBM has provided some hints about what these future Power8 machines it will be launching later this year might look like, in what it calls statements of direction. Here is one of these statements:

IBM plans to bring Power8capability to the full Power Systems portfolio, with the intent to deliver the most scalable, highest performing enterprise-class Power System with an advanced version of the Power8 processor. These enterprise systems are designed to deliver the industry’s best per-core performance and will support AIX, Linux and IBM i applications, concurrently. The new system architecture incorporates the resiliency characteristics of IBM's Power 795 with the intent to drive substantial improvements in energy efficiency and floor space utilization for mid-sized and large enterprises. These systems will use IBM's modular design to enable clients to leverage the innovations in Power8 processor technology and the latest advancements in enterprise-class systems and Capacity on Demand, to help enable growth seamlessly and affordably.

And here is another one:

IBM also plans to provide upgrade paths from the current Power7+ Power 770 and 780 servers to enterprise-class Power8 processor-based servers. It is intended that clients with multiple systems can leverage PowerVM Live Partition Mobility to help maintain application availability during the upgrade process.

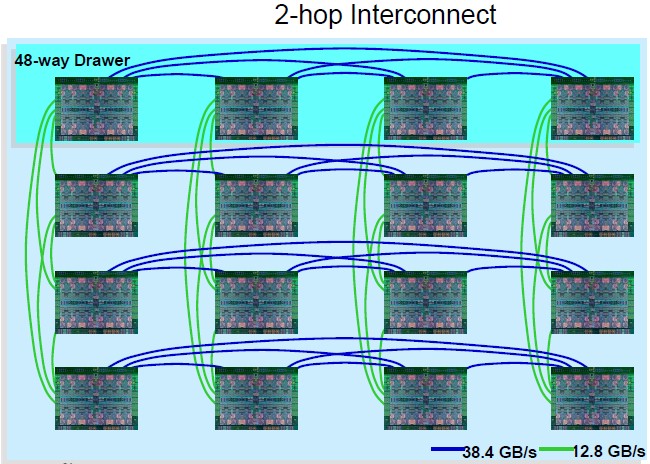

The way that the Power8 chip is architected, the on-chip NUMA electronics has an extra port compared to the Power7 and Power7+ processor for linking sockets together. Specifically, each Power8 chip has three links that operate at 38.4 GB/sec that link local processors on a system board to each other and another three that run at 12.8 GB/sec that link processors in remote systems boards. The new NUMA clustering allows for sixteen sockets to be linked in a cache-coherent cluster with a maximum of one or two hops between the sockets.

With Power7 and Power7+ machines, the NUMA system interconnect had anywhere from one to three hops between processor sockets. With fewer hops, performance on real-world workloads should improve with Power8 systems. If the coupling is tight enough, IBM may not even push out to the 32 sockets of the Power 795, which glues together eight four-node systems using a set of glue chips. IBM can do 16 sockets without any glue chips, and it can get anywhere from 2X to 2.5X the amount of performance out of each Power8 socket compared to a Power7 socket. That means it can potentially get the same or better performance out of a machine with 128 Power8 cores compared to a Power 795 with 256 Power7 cores. Depending on how many customers are hitting the performance ceiling on the Power 795, IBM could skip putting out a 32-socket Power8 machine and just got with the 16-socket machine with 16 TB of memory.

As for midrange machines, it seems likely that IBM will offer machines with four or eight sockets that compete head-to-head with Xeon E7 processors from Intel. And it is also reasonable to expect that in all of the high-end machines, IBM will offer Power8 chips that have the full complement of a dozen cores as well as variants that have fewer cores. A Xeon E7 midrange machine has 24 memory slots per socket, while the Power8 machine has up to 32 memory slots per socket. Intel has a slight core advantage, topping at 15 cores compared to 12 cores for Power8, but IBM can in theory, using 32 GB memory sticks, get 4 TB on a four-socket machine compared to 3 TB on a Xeon E7 machine. The IBM processors have much more cache and memory bandwidth, too, so it will be interesting to see how these so-called midrange boxes play out against each other running real workloads.

Here's another interesting statement of direction from IBM about its future Power8 machines:

IBM plans to introduce a business insight solution to provide IBM customers with a fully integrated solution for structured and unstructured data analytics using the Power S822L running Linux, a GPFS Storage Server using Power servers, select IBM Platform Computing software, and field-programmable gate array (FPGA) compression.

This is precisely the kind of machine that IBM wants to sell against X86 iron running a generic Hadoop distribution. IBM's Netezza data warehouses already use FPGAs to compress and chew on data stored in a relational database, and it is likely that some of the assets learned from Netezza are being redeployed to help accelerate Hadoop running atop Platform Symphony middleware and the GPFS file system, which is now being called Elastic Storage by Big Blue these days.

Schroeter did not provide timing for the remaining Power Systems launches, but you can bet that IBM will try to steal some of Intel's thunder if the "Haswell" Xeon E5 launch is coming out in early September at Intel Developer Forum as expected. If not early September, then certainly before the third quarter ends so IBM can start selling into the fourth quarter. The FPGA-accelerated data analytics setup could ship anytime between now and the end of the year, and earlier is probably better there, too.