IBM Chip Talks Stall as Focus Shifts to R&D

IBM Microelectronics' fire sale of its flagging semiconductor unit has yet hit another snag after talks between the company and potential suitor Globalfoundries reportedly broke down over how much IBM would pay to get rid of its chip business.

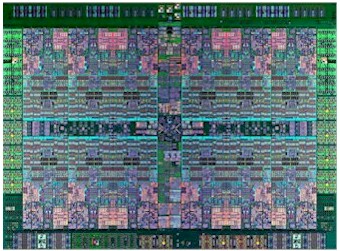

The stalled talks follow a July announcement by IBM that it would invest $3 billion in chip research and development. Those moves along with recent statements by IBM chip researchers indicate the company wants to move away from chip production, rely on semiconductor foundry suppliers like Globalfoundries to produce its Power chips and focus on next-generation chip technologies that could advance its cloud and cognitive computing businesses.

Citing a source close to the negotiations, Bloomberg and others reported that IBM was offering Globalfoundries $1 billion to take its loss-making chip making operations. Globalfoundries is seeking twice that amount, Bloomberg reported, to offset the IBM unit's losses.

The Poughkeepsie Journal newspaper also reported that the national organizer of the worker group Alliance@IBM had been told by an IBM Microelectronics executive that "the deal was off."

A potential sale involves IBM fabs in East Fishkill, N.Y., and Burlington, Vt. Both are equipped with dated process technologies, although East Fishkill continues to produce Power chips used in servers and perhaps future mainframe systems.

Those chip plants have been a weight on IBM's bottom line since it largely abandoned efforts to keep pace with fast-moving chip manufacturing technology. IBM's fab in East Fishkill, N.Y., cost about $2.5 billion to build.

Further complicating a transaction is IBM's "Trusted Foundry" program with the federal government that requires suppliers to meet stringent chip requirements. Hence, federal agencies would likely have to sign off on any deal between IBM and Globalfoundries.

Globalfoundries, which is attempting to gain a foothold in the global chip foundry sector dominated by Taiwan Semiconductor Manufacturing Co. (TSMC), is primarily interested in IBM's engineering work force and semiconductor intellectual property. The chipmaker, which is owned by an investment arm of the Abu Dhabi government, reportedly considers IBM's fabs to be outdated.

TSMC currently dominates mainstream 28-nanometer semiconductor manufacturing. Globalfoundries has licensed a Samsung chip-making process at the next node, 14 nanometers, that is expected to enter production later this year. Globalfoundries, Samsung and IBM were partners on a chip alliance called Global Platform. IBM appears to be easing itself out of that effort.

As recently as last fall's International Electron Devices Meeting (IEDM), the premiere technical conference for chip designers, IBM engineers remained engaged with partners like Globalfoundries and Samsung.

Speaking at IEDM, Brian Greene, an IBM senior engineer in charge of its 14-nanometer chip fabrication architecture, cited chip density scaling and incorporation of new epitaxial materials along with adoption of new device architectures as the company's biggest challenges.

Among the issues faced by chipmakers are unrelenting schedule pressure that requires them to get a new generation of technology out the door every two years. Greene provided a hint as to IBM's emerging focus on chip R&D and intellectual property licensing when he noted that the company's biggest challenge is "how much we can learn in the [shorter] time we have" to learn it.

Related

George Leopold has written about science and technology for more than 30 years, focusing on electronics and aerospace technology. He previously served as executive editor of Electronic Engineering Times. Leopold is the author of "Calculated Risk: The Supersonic Life and Times of Gus Grissom" (Purdue University Press, 2016).