Weak Growth For Servers In Q2, But Still Growth

The global economy seems to be improving, despite political unrest in various parts of the globe, and the server market managed to get some growth in both revenues and shipments in the second quarter ended in June. Even Europe, which had seen ten quarters of revenue decline, had a bit of a bounce in the period.

That server makers were able to get growth at all with expected "Haswell" Xeon E5 v3 processor announcements on the horizon is a testament to the immediate processing needs of companies around the world. They just can't wait, even though Intel is pretty predictable in terms of having server announcements in March or September and they could align their buying plans with Intel's product roadmaps. Clouds are growing so fast at many institutions, and similarly are being scaled up among hyperscale datacenter operators that run far fewer applications but at a much larger scale, that they need to buy iron pretty much continuously. This provides a great sense of relief to Intel, of course, which is the dominant supplier of server processors and chipsets in the world.

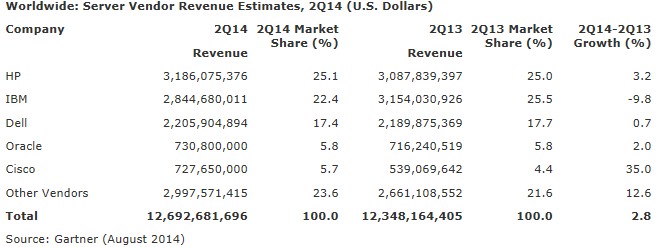

In the second quarter, the analysts at Gartner reckon that the world consumed 2.49 million servers, a 1.3 percent increase compared to the year ago period. Despite declines in revenues for big iron like mainframes and Unix servers based on RISC or Itanium processors, the overall server revenue pie rose by 2.8 percent to $12.69 billion. The Unix system market continues to decline, but a little more slowly than it has in past quarters, with revenues across all vendors of such machines down 23.2 percent to $1.22 billion and shipments down 7.9 percent to a mere 24,554 units. Oracle is the largest shipper of Unix gear, having inched past IBM with 11,108 machines compared to 9,248 for Big Blue, but IBM generated $636.2 million from its AIX gear compared to $308.5 million for Oracle's Sparc machinery. Hewlett-Packard's Integrity and Superdome Itanium machines running HP-UX accounted for a mere 3,293 machines and $203.6 million in the quarter.

As you might expect, X86-based systems, which mostly run Windows and Linux these days, accounted for most of the server shipments in the quarter and an increasing share of revenues. Gartner figures that server makers (including those who contract out to build their own) shipped 2.47 million machines based on X86 processors in the second quarter, an increase of 1.4 percent compared to the year-ago period. Thanks to companies buying beefier configurations, total X86 server revenues rose by 8.1 percent to $10.13 billion. The average selling price of an X86 server rose by 6.5 percent to $4,110, and it stands to reason that there are millions of very inexpensive machines being acquired by hyperscale datacenter operators that are trying to pull down that average mightily and yet cannot as enterprises buy heftier machines to support their virtualized workloads and databases.

X86 machines accounted for a stunning 98.9 percent of shipments and 79.8 percent of revenues in the quarter. It will take a massive wave of ARM-based servers to enter the datacenter to make even a small dent in the X86 share in the coming years, and because ARM is a RISC architecture, it will prop up the RISC data that has been dwindling since the dot-com bust more than a decade ago. ARM machines, should they take off, will budge the needle on server shipments long before they take a bite out of X86 revenue share – much as X86 machinery did to Unix and mainframe machines in the late 1990s. If – and that is still an if – ARM servers take off. Without support for Windows, ARM machines will only appeal to those parts of the server market that have opted for Linux.

Other machines, which are made up mostly of IBM mainframes with a smattering of proprietary midrange machines but which also includes mainframes and proprietary systems from Unisys, Bull, Fujitsu, NEC, and others, saw a 2.2 percent decline.

There are a few interesting things going on in the market. First, Cisco Systems was able to get a 35 percent growth in sales in the second quarter, to $727.7 million, with only a 2 percent increase in shipments, to 79,270 machines. Cisco now ranks as the fifth largest server maker in the world and at current growth rates, it will surpass Oracle in perhaps one or two quarters. IBM, which has seen declines in X86 server since rumors surfaced about its desire to sell its System x server business in early 2013, has actually stabilized its X86 business somewhat, with revenues down only 3.1 percent to $1.07 billion. But declines in mainframes and Power Systems pulled IBM's overall sales down 9.8 percent to $2.82 billion, giving it the number two position behind HP. With $3.19 billion in sales and 569,795 shipments in the second quarter, HP was both the top seller and the top shipper. However, HP's shipments were down 2.9 percent and it was nonetheless able to drive up revenues by 3.2 percent. Dell also saw an 11.4 percent decline in shipments to 487,923 units, but boosted revenues by seven-tenths of a percent to $2.21 billion.

The most interesting part of the data is buried in the Others category, which has the supercomputer makers as well as the original design manufacturers who make machines for those who design them for their own use. Other vendors accounted for 1.08 million server shipments, a stunning 43.2 percent of shipments and increasing by 10.9 percent over the year-ago period. These Others accounted for just under $3 billion in revenues, or just shy of a quarter of the market and representing 12.6 percent revenue growth. Interestingly, the average selling price for a machine among these Others was a mere $2,785, up only 1.6 percent.