XPliant Takes On Broadcom, Intel With Malleable Ethernet Switch Chips

Switch chip upstart XPliant, founded in 2011 by a bunch of techies from Cisco Systems, Juniper Networks, Brocade Communications, and Marvell and in the process of being acquired by network and server chip maker Cavium Networks, has unveiled its first round of Ethernet switch ASICs and its intention to upset the current order among switch chip and switch makers.

XPliant has been operating in stealth mode for the past three years, and not much was known about it even after Cavium, which was one of the early investors in the company, announced back at the end of July that it would be acquiring XPliant to build out its networking business. Cavium has been building network processors for years and is in the middle of putting the finishing touches on its ThunderX ARM-based processors for servers, and the matchup between the ThunderX chips and the XPliant Ethernet chips could make for a potent combination in the datacenter. Cavium has provided $15 million of the $18.9 million in debt financing that XPliant raised in the past two years to get its Ethernet ASIC designs onto the drawing boards and into the fabs at Taiwan Semiconductor Manufacturing Corp. Having helped XPliant create its new packet switch architecture and a method to make switch chips more malleable and therefore able to adopt new protocols without having to go back and re-etch the chips, Cavium figured it had best keep the XPliant technology to itself and take on the incumbents in Ethernet ASICs.

And so it acquired XPliant for $40 million in cash and $35 million in Cavium stock in addition to that $15 million startup investment. The deal is expected to close in the first quarter of 2015, company president and co-founder Guy Hutchison tells EnterpriseTech. And Hutchison can't reveal more about the ThunderX and XPliant integration plans until after that deal is done.

But with XPliant sampling its CNX family of Ethernet ASICs in the fourth quarter, the startup figured that it is probably a good time to start telling the world what it is up to and how it intends to take on the incumbents to storm the hyperscale, cloud, and enterprise datacenters of the world with more powerful and flexible Ethernet switch chips. To come up with its designs, XPliant did not only ask the Ethernet switch makers what they wanted, but the largest datacenter operators who want more speed in their networks and who want to be able to make changes in their networks more quickly as well.

"We talked to the Googles, Facebooks, Yahoos, Microsofts, and so on, and they are the ones that are really driving innovation now," explains Dan Tuchler, head of marketing for XPliant who had the similar job at IBM's networking division until it sold it off to Lenovo as part of its System x divestiture. "They are pushing the vendors to create new stuff that fits what they need. They are not waiting for IEEE standards, they are pushing ahead. They want to go faster than what has been normally done on both the compute side and the networking side."

As a proxy for the need for flexibility, Tuchler says you can take a look at what the market for software-defined networking software for the enterprise and cloud/service provider segments will look like in the next few years, and according to IDC it will have a compound annual growth rate of 89.4 percent, rising from $960 million in 2014 to over $8 billion in 2018. As for the need for speed, just take a look at the ramp for higher Ethernet speeds. Tuchler cites data from Dell'Oro Group, which projects that the market for switches with speeds in excess of 10 Gb/sec will grow at a compound annual growth rate of 60 percent, from $828 million in 2013 to $8.2 billion in 2018. That's ten times faster than the switch market at large, and that is with the datacenter taking a bigger and bigger bite out of the entire switch market.

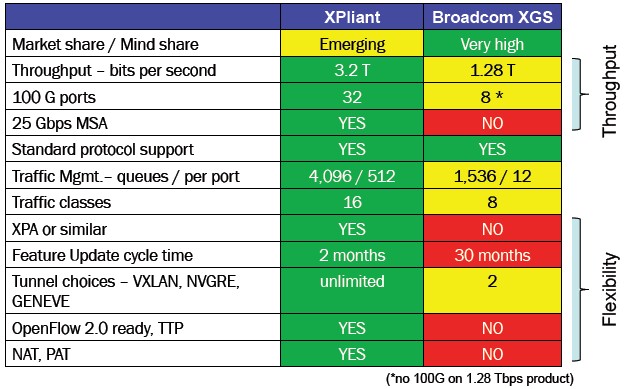

XPliant thinks its new family of programmable switch chips, called the CNX88000 series, is the answer to both problems. First, they are fast. The four ASICs in the family are based on 10 Gb/sec or 25 Gb/sec SERDES and cover a wide range of throughput and port speeds and counts. The top-end part offers 3.2 Tb/sec of aggregate switching bandwidth and using the 25 Gb/sec SERDES it can be configured with a whopping 128 ports running at the 25 Gb/sec speeds that the hyperscale datacenter operators wanted when they launched their own standard earlier this year. (A standard that has subsequently been adopted by the IEEE.)

The switches that can be made from these initial XPliant ASICs will be a better fit for the enterprise datacenters of tomorrow, in perhaps two or three years from now, and therefore, more like the networking in datacenters that hyperscale companies would like to build right now. The spine in a high-end datacenter is typically a 32 port device running at 40 Gb/sec with the mesh running at the same speed; top of rack switches tend to have eight 40 Gb/sec uplinks and 48 downlinks to servers running at 10 Gb/sec. But the future, says XPliant, is having a spine switch with 32 100 Gb/sec ports and a top of rack switch with 48 downlinks running at 25 Gb/sec and eight uplinks to the mesh running at 100 Gb/sec.

Bandwidth is only one element of speed that the hyperscale datacenter operators are interested in. The ability to absorb new protocols quickly is also something they want in addition to having alternate network operating systems that run on their switches. It takes about 18 months to create a new switch chip with better feeds and speeds and supporting new protocols, and it takes another 12 months or so to get the ASIC into switches, tested, and out into the field by switch manufacturers. The need for speed and to support new protocols has enterprise customers tossing fixed switches into the garbage every three or four years, with modular switches used in the spine and core layers sticking around for six to eight years, according to Tuchler. Among cloud operators, fixed and modular switches have only a three-year lifespan because protocol needs change and so do bandwidth requirements. In fact, the need to support the VXLAN protocol Layer 2 overlays in clouds has been a boon to switch makers.

But what switch customers would really like is to have a device that can have a new protocol added on the fly, and this is what XPliant has come up with. Neither Hutchison nor Tuchler will be specific about how this is accomplished, but it involves cramming the device with lots of registers that allow for myriad parameters to be set and for switches to be loaded with "personalities" that incorporate new protocols. While many of the features of the chip are etched in the transistors, other features are stored in these registers. So the net effect is that the XPliant chips are in many ways as flexible as the combination of a generic network processor combined with a field programmable gate array (FPGA) and but have the look and smell of a regular ASIC.

"This is secret sauce so we are not going to get into a lot of detail," Tuchler tells EnterpriseTech. "In a traditional switch, where you have to connect part A to part B, that would be hard wired. There is something that is kind of like a register that tells you how to connect A to B. It is not microcode, it is not a bunch of little ARM processors. It is similar to the logic you find in a switch. It abstracts out and decouples things that are normally fixed in a switch and makes them more free form. And by doing that, we can implement a much broader set of features than you could otherwise. When new protocols come along, you can create a personality that tells the different parts of the switch how to behave to implement that new protocol."

"This is secret sauce so we are not going to get into a lot of detail," Tuchler tells EnterpriseTech. "In a traditional switch, where you have to connect part A to part B, that would be hard wired. There is something that is kind of like a register that tells you how to connect A to B. It is not microcode, it is not a bunch of little ARM processors. It is similar to the logic you find in a switch. It abstracts out and decouples things that are normally fixed in a switch and makes them more free form. And by doing that, we can implement a much broader set of features than you could otherwise. When new protocols come along, you can create a personality that tells the different parts of the switch how to behave to implement that new protocol."

A side effect of this approach is that datacenters will be able to buy a single physical switch and stock one machine and give it five or six different personalities, acting in one case like a spine switch and in another as a leaf switch, for example. This kind of malleability through software is what has made the X86 server platform ubiquitous, and clearly XPliant and its soon-to-be-new-parent wants the same kind of widespread deployment for its switch chips without sacrificing the performance that comes from custom logic. These tweaks are not limited to just protocols and other features, but also dynamically assigning port speeds.

But perhaps the most important thing is that it takes the time to implement a new protocol down from 30 months to maybe two months – the chips already support the GENEVE tunneling protocol, which is still in the final phases of development and ratification, just to show you how fast it can move. This malleability will also at least double the technical life of a switch in a cloud or hyperscale datacenter from around three years to at least six years, by Tuchler's estimate.

XPliant is shipping the software development kit for its ASICs, including a full software-emulated version of the chip, so switch makers and hyperscale datacenter operators can play around with the device and start porting their network operating systems to them. When asked who was interested in the XPliant devices, Tuchler said that it was hard to find switch makers and cloud and hyperscale shops who were not intrigued, and he added that companies were particularly interested in the top-end 3.2 Tb/sec part to use the 32 ports running at 100 Gb/sec as a backbone for the datacenter. That top-end CNX88091 part is the first one to sample in the fourth quarter and the others will follow shortly; the exact schedule was not divulged.