AMD Announces Layoffs as it Misses Q3 Targets

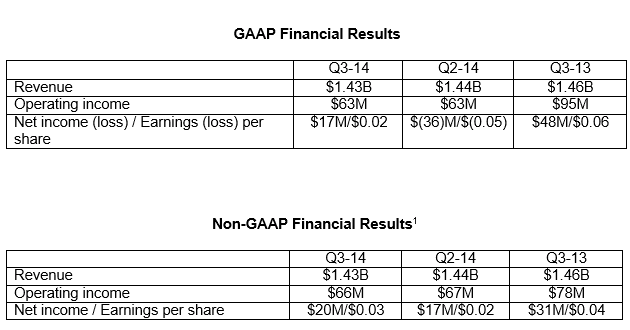

AMD has announced revenue for the third quarter of 2014 of $1.43 billion, operating income of $63 million and net income of $17 million, or $0.02 per share. Non-GAAP operating income was $66 million and non-GAAP net income was $20 million, or $0.03 per share.

“AMD’s third quarter financial performance reflects progress in diversifying our business,” said Dr. Lisa Su, AMD president and CEO. “Our Enterprise, Embedded and Semi-Custom segment results were strong; however, performance in our Computing and Graphics segment was mixed based on challenging market conditions that require us to take further steps to evolve and strengthen the financial performance of this business. Our top priority is to deliver leadership technologies and products as we continue to transform AMD.”

Effective July 1, 2014, AMD reorganized into two business groups, one focused on the traditional PC market and the second focused on adjacent high-growth opportunities.

Accordingly, AMD has two reportable segments:

- Computing and Graphics, which primarily includes desktop and notebook processors and chipsets, discrete GPUs and professional graphics; and

- Enterprise, Embedded and Semi-Custom, which primarily includes server and embedded processors, dense servers, semi-custom SoC products, engineering services and royalties.

Quarterly Financial Summary

- Gross margin was 35 percent in Q3 2014. Gross margin was flat sequentially and included a $27 million, or 2 percent benefit, from revenue related to technology licensing.

- Cash, cash equivalents and marketable securities were $938 million at the end of the quarter, essentially flat from the prior quarter.

- Total debt at the end of the quarter was $2.20 billion.

- Computing and Graphics segment revenue decreased 6 percent sequentially and decreased 16 percent year-over-year. The sequential decrease was primarily driven by lower chipset and GPU sales. The year-over-year decline was primarily due to decreased notebook processor and chipset sales.

- Operating loss was $17 million, compared with an operating loss of $6 million in Q2 2014 and operating income of $9 million in Q3 2013. The sequential decrease was primarily driven by lower revenue while the year-over-year decrease was primarily driven by lower revenue partially offset by lower operating expenses.

- Client average selling price (ASP) increased sequentially and year-over-year primarily driven by a richer mix of notebook processor sales.

- GPU ASP decreased sequentially due to lower desktop GPU ASP and increased year-over-year.

- Enterprise, Embedded and Semi-Custom segment revenue increased 6 percent sequentially and 21 percent year-over-year primarily driven by increased sales of semi-custom SoCs.

- Operating income was $108 million compared with $97 million in Q2 2014 and $92 million in Q3 2013. The sequential and year-over-year increase was primarily due to increased sales of semi-custom SoCs.

- Embedded revenue grew by double digits on a percentage basis sequentially.

Q4 2014 Restructuring and Transformation Initiatives

As a part of AMD’s ongoing transformation work, the company has developed a targeted restructuring plan to better position AMD for profitability and long-term growth while aligning investments and resources with high-priority opportunities.

The restructuring plan, which will be largely implemented in Q4 2014, is expected to:

- Reduce global headcount by 7 percent, largely expected to be completed by the end of Q4 2014;

- Align AMD’s real estate footprint with its reduced headcount;

- Result in a restructuring and impairment charge of approximately $57 million in Q4 2014, primarily related to severance, and a restructuring charge of approximately $13 million in 1H 2015, primarily related to real estate actions; The company expects to make cash payments related to these actions of approximately $34 million in Q4 2014 and $20 million in 1H 2015;

- Result in operational savings, primarily in operating expenses, of approximately $9 million in Q4 2014 and approximately $85 million in 2015.

“While decisions that impact the size of our global team are never entered into lightly, this is the right step to ensure we prioritize our resources and engineering investments in our highest-priority opportunities that can drive improved profitability and long-term growth,” said Dr. Su.

Recent Highlights

- AMD appointed Dr. Lisa Su as president and CEO and a member of the board of directors, succeeding Mr. Rory Read who will remain with the company through 2014 to advise on the transition. Mr. Joseph Householder was also appointed to the company’s board. Mr. Householder currently serves as executive vice president and chief financial officer of Sempra Energy.

- AMD and Synopsys announced a multi-year agreement, with Synopsys acquiring rights to AMD’s interface and foundation IP. The IP partnership will provide AMD with access to a range of Synopsys tools and IP for advanced FinFET process nodes.

- AMD expanded its award-winning AMD Radeon R9 series graphics family with the launch of the AMD Radeon R9 285 graphics card designed to run the most demanding games at the highest settings.

- AMD completed its most advanced APU lineup to date for the component channel with the introduction of new AMD A-Series APUs with HSA features and GCN architecture for the system builder and DIY market, along with new APUs designed for smaller form factor gaming and home theater PC (HTPC) systems.

- Demonstrating its leadership in building a robust software ecosystem for 64-bit ARM servers, AMD announced immediate availability of the AMD Opteron A1100-Series development kit, featuring AMD’s first 64-bit ARM-based processor, and showcased the first public demonstration of Apache Hadoop running on an ARM Cortex-A57-based AMD Opteron A-Series processor. AMD is the first company to provide a standard ARM Cortex-A57-based server platform for software developers and integrators.

- AMD expanded its AMD FirePro professional graphics offerings with the introduction of 4 new next-generation AMD FirePro W-series professional graphics cards that deliver at least 2x2 more graphics memory over the previous generation, multi-display 4K capability and increased compute performance. AMD secured several new design wins with tier-1 OEMs, including multiple HP mobile and desktop workstations. AMD also introduced the most powerful server GPU ever built for High Performance Computing with the AMD FirePro S91503.

- Mentor Graphics announced the availability of commercial Embedded Linux software, enabling developers to easily migrate to new commercially-supported versions for the AMD Embedded G-Series SoC and CPU, and the AMD Embedded R-Series APU.

- AMD announced a new technology partnership with OCZ Storage Solutions, a Toshiba Group Company, for AMD Radeon-branded Solid State Drives (SSDs).

- In collaboration with Canonical, AMD announced a ready-to-deploy OpenStack private cloud based on the SeaMicro SM15000 server. The “out of the box” experience is meant to ease the complexities of deploying OpenStack technology and automates complex configuration tasks, simplifies management, and provides a graphical user interface to dynamically deploy new services on demand.

- Dow Jones named AMD to the Dow Jones Sustainability Index (DJSI) North America, marking more than a decade-long appearance on the list and exemplifying the company’s legacy of corporate responsibility and commitment to social, economic and environmental issues.