Datacenter Spending Steady As Cloud Shift Accelerates

Spending on datacenter operations remained steady during the second quarter of 2015 while 25 percent of those administrators responding to a survey said they planned to boost datacenter spending for retrofits over the next 90 days.

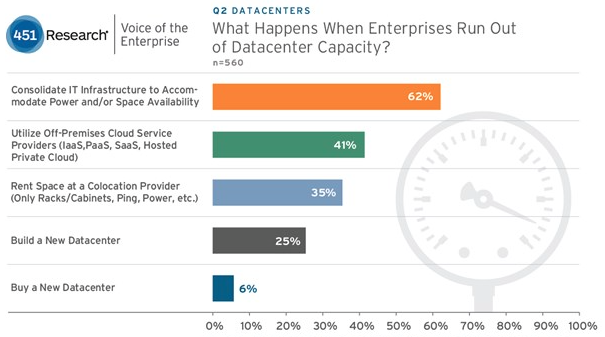

As datacenter operators hit maximum capacity utilization, however, most are looking to colocation services or cloud service providers rather than building new datacenters.

Market tracker 451 Research reported this week that 87 percent of datacenter operators it surveyed in North America and Europe said they either held the line or increased spending during the second quarter.

Medium-sized to large financial services and healthcare organizations led the way over the previous three months with increased spending for IT infrastructure such as racks and cabling, power equipment and datacenter management software, 451 reported on Tuesday (June 30).

"To support growing business demands on IT, enterprises are freeing up budgets and investing in modernizing neglected datacenter facilities," Dan Harrington of 451 Research noted in releasing the survey results. "Those equipment vendors with offerings that target enterprise clients' larger premium sites will see the greatest opportunity."

The market researcher reckons that organizations reevaluate their datacenter needs when they hit 75 percent capacity utilization. Most would rather go with a cloud provider or a colocation option than build a new datacenter. As a result, the colocation market grew at an 8-percent clip in the second quarter on a square footage basis.

Hence, colocation and cloud service providers are forecast to grow "as enterprises require additional capacity and increasingly need to be more agile in responding to growing business demands," Harrington added. "Facilities vendors who target colocation and cloud service providers also will benefit from this increased enterprise demand."

Source: 451 Research

Top cloud service providers during the second quarter were, in descending order, Amazon Web Services, Microsoft, Salesforce, Rackspace and Google. Top colocation providers according to rank were: Equinix, AT&T, Sungard, CenturyLink and Digital Realty Trust.

Along with racks and cabling and datacenter software, datacenter spending also was concentrated on power distribution and air handling equipment. The survey found that Schneider Electric was the preferred vendor in categories like uninterruptable power supplies, power distribution units, management software as well as racks and cabling. Emerson Network Power also was among the top datacenter vendors for cooling and air handling equipment.

As datacenter operators seek to squeeze more efficiency out of their operations, more are turning to management software. This trend is being driven by the consolidation of local datacenters and server rooms in favor of colocation services and the shift from on-premise to hybrid cloud infrastructure.

"Over the next two years, most organizations expect to close many of their smaller local datacenters and server rooms, indicating a continued trend toward fewer overall datacenter sites," the market researcher noted.

Datacenter consolidation and "migration projects" will translate into more high-end, centralized datacenters, 451 Research predicted. Hence, overall datacenter square footage owned by global enterprises remains flat.

It reported that about 37 percent of current datacenter spending focuses on retrofits or upgrade projects. "Existing datacenters will need to be upgraded, considering 62 percent of organizations would rather consolidate their IT infrastructure than build a new datacenter," the market researcher noted.

Related

George Leopold has written about science and technology for more than 30 years, focusing on electronics and aerospace technology. He previously served as executive editor of Electronic Engineering Times. Leopold is the author of "Calculated Risk: The Supersonic Life and Times of Gus Grissom" (Purdue University Press, 2016).