Qualcomm Takes On Intel Xeon’s Datacenter Reign

Qualcomm Server 16

Intel could face increased pressure, now Qualcomm and IBM are investing heavily in new processors that bridge the gap between today's Xeon systems and enterprise-focused high performance computers.

Smartphone chip giant Qualcomm on Thursday unveiled early specifications for a new ARM-based datacenter on a chip designed to expand its mobile capabilities onto server processors and targeted at hyperscale datacenter customers. These chips could support infrastructure as a service, big data, platform as a service, and machine learning, according to Qualcomm (NASDAQ: QCOM).

Known primarily as a maker of smartphone and mobile chips, Qualcomm's 24-core 64-bit ARMv8 processors was shown running GNU/Linux and OpenStack, further underscoring the importance of Linux in the enterprise. Qualcomm demonstrated the processors with the KVM hypervisor running a web server and video streaming, among other actions.

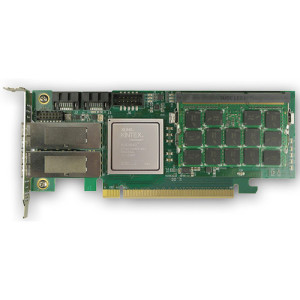

Qualcomm also disclosed partnerships with Mellanox and Xilinx. Under a collaboration between Mellanox and Qualcomm subsidiary Qualcomm Technologies, Mellanox will offer Ethernet and InfiniBand interconnect solutions that leverage Qualcomm Technologies' ARM instruction set-based server CPUs that have been optimized for scalable server and storage infrastructures. Xilinx makes field programmable field arrays (FPGAs), or reprogrammable chips.

"Intel finally has a credible challenger in the server market as Qualcomm has made an entrance in conjunction with partners Mellanox and Xilinx," said Richard Windsor, analyst at Edison Investment Research, in an email. "With growth rapidly declining in smartphones, tablets in negative territory and MediaTek aggressively attacking at the high-end, Qualcomm has been looking for new avenues for some time."

It is, most executives agree, a big goal: Today, about 95 percent of servers operate on Intel Xeon chips, according to published reports. But enterprises want open systems, more options, and competitive pricing, executives from developers such as IBM have said.

Qualcomm believes it can succeed given its history of success in smartphones, said company president Derek Aberle.

"We have a long history of developing custom low-power, high performance architectures," he said in Forbes. "We can leverage our expertise into a world leading position in the data center. … We realize this is a long-term investment and it’s going to take years before we see a return."

Qualcomm already has spent almost three years working on ARM technology. The developer's investment prompted ARM Holdings (ARMH) to increase its market share targets to 25 percent by 2020, up from its prior estimate of 20 percent, Hans Mosesmann with Raymond James told Barrons. Qualcomm is at least a year away from launching product, Mosesmann said, and is at the point of collecting information, not crafting servers.

Acquisition would accelerate Qualcomm's path to potential success in the high-performance server market, some pundits said. The company lacks expertise and products in areas such as fabric and networking, said Christopher Rolland with FBR & Co., in Barrons. But purchasing Advanced Micro Devices for its custom ARM server core, fabric, and networking solutions, plus Cavium for networking and compute offerings, would immediately boost Qualcomm's capabilities, he said.

"Both purchases would barely put a dent in Qualcomm’s massive cash balance and would give the company an entrance to large high growth markets," Rolland told Barrons.

Related

Managing editor of Enterprise Technology. I've been covering tech and business for many years, for publications such as InformationWeek, Baseline Magazine, and Florida Today. A native Brit and longtime Yankees fan, I live with my husband, daughter, and two cats on the Space Coast in Florida.