‘Brexit’ Currency Swings Hit IT Spending

The British exit, or "Brexit," from the European Union is adding uncertainty to global IT markets as the British pound sinks to new lows.

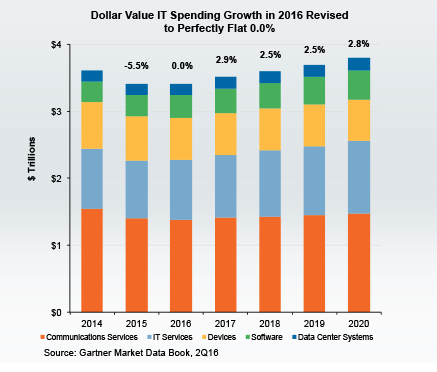

Worldwide IT spending for this year is forecast to be flat, representing an increase over negative growth this time last year, according to a quarterly spending forecast that also considers the consequences of the British exit from the EU.

Market watcher Gartner (NYSE: IT) cited currency fluctuations as the primary reason for its tepid forecast. Global currencies have been rocked by the U.K. decision in June to leave the EU. However, Gartner said Thursday (July 7) its forecast assumes the U.K. would remain.

"While the U.K. has embarked on a process to change, that change is yet to be defined," Gartner's John-David Lovelock explained in a statement releasing its latest IT spending forecast. "The 'leave' vote will quickly affect IT spending in the U.K. and in Europe while other changes will take longer.

"Staff may be the largest immediate issue," Lovelock continued. "The long-term uncertainty in work status will make the U.K. less attractive to new foreign workers. Retaining current non-U.K. staff and having less access to qualified new hires from abroad will impair U.K. IT Departments."

Indeed, currency swings have roiled the British economy since the so-called "Brexit" vote, with declines in the value of the British pound reducing its gross domestic product to the point where France has briefly surpassed Britain as the world's fifth largest economy.

Despite a "lackluster" global IT spending forecast totaling $3.41 trillion this year, the market watcher notes that the pace of change in 2016 "will never again be as slow as it is now." Gartner said the shift to digital platforms, Internet of Things and even the algorithm business are poised to explode over the next several years. Funding these initiatives has prompted global enterprises to refocus on "cost optimization efforts" such as software-as-a-services as a replacement for software licenses. Those licenses often come with steep "true-up" costs when licensees are found to be out of compliance with software contracts. Software audits designed to spot unused "shelfware" add to these costs.

"It is precisely this new breadth of alternatives to traditional IT that will fundamentally reshape what is bought, who buys it and how much will be spent," Gartner added. As a result, global IT spending is expected to trend upward through 2020 at a 2.5-percent clip over the next four years.

Indeed, software spending remains one of the few bright spots in the last IT forecast, growing a relatively healthy 5.8 percent this year. IT services that include consulting are forecast to increase 3.7 percent this year as digital business projects roll out.

Datacenter spending is expected to increase by a modest 2 percent in 2016 as equipment vendors look to expand Asian markets amid smaller margins for servers and other datacenter equipment. Gartner reported last month that the global server market continued to slow during the first quarter of 2016 as revenues declined while shipments rose only modestly, indicating that average selling prices continue to slip.

Related

George Leopold has written about science and technology for more than 30 years, focusing on electronics and aerospace technology. He previously served as executive editor of Electronic Engineering Times. Leopold is the author of "Calculated Risk: The Supersonic Life and Times of Gus Grissom" (Purdue University Press, 2016).