Cisco Cuts More Jobs As Switching And Routing Stall

Networking giant Cisco Systems is struggling in its core switching and routing markets and feeling the effects of economic and political turmoil in emerging markets, all of which put a damper on sales and profits as it closed out its fiscal 2014 year in July. The declines in the final quarter were modest, but Cisco must be thinking that the prevailing conditions are going to persist because it also announced that it would be laying off approximately 6,000 employees, or about 8 percent of its more than 74,000 workforce.

The layoffs will cost Cisco about $700 million in charges, and echo the 4,000 job cuts that Cisco announced this time last year as sales and profits were under pressure due to intense competition and product transitions in its core switching and routing markets.

In the quarter ended in July, Cisco's revenues fell by a half point to $12.4 billion, and its net income dropped by 1 point to $2.2 billion. For the full year, revenues came in at $47.1 billion, down 3 percent, while net income was $7.9 billion, down 21.3 percent. That is a very big drop in earnings, and frankly, it is probably an unavoidable one given the competitive pressures in the markets that Cisco engages in.

While Cisco has managed the transition from plain Catalyst switches to the Nexus converged switches, which can support Fibre Channel storage traffic atop Ethernet and which are integral to its Unified Computing System blade servers, it has been tough to maintain the historical profit margins Cisco has been used to with its switching and routing. Moreover, for a long time in the IT industry, X86 servers have been less profitable than switches, and even though UCS is a much more profitable platform than plain vanilla rack servers, the margins, even Cisco concedes, are somewhere between that of switches and of servers. Cisco usually has gross profits in the range of 65 percent for its switching products, and that is unheard of in commodity servers. Add in the move to open networking, where hyperscale datacenter operators and large enterprises are looking to have whitebox switches and a modular network switching and routing software stack that offers choice like X86 servers do, and Cisco is under intense pressure. The company has the dominant market share in its switching and routing markets, it is still throwing off cash and adding to its hoard. Cisco grew its cash pile by $1.5 billion in fiscal 2014, which stands at $52.1 billion. That is more than one year's revenue in the bank. This is an amazing accomplishment for a company that is largely a hardware vendor, and it also shows why so many competitors are always gunning for Cisco.

In the fourth quarter, Cisco's product sales were off 2.1 percent to $9.53 billion, while services revenues rose 5.4 percent to $2.83 billion. Gross margins dipped a tenth of a point below 60 percent, which is lower than where Cisco likes it to be.

On a conference call with Wall Street analysts, Cisco CEO John Chambers did not say where the company would be making job cuts, but he did say that the company would be reinvesting nearly all of the savings it gets through the layoffs into key growth areas, including its datacenter, cloud, software, and security businesses. Chambers also sounded a note of caution to Wall Street, having seen many transitions and plenty of choppy economic water over his long time at the helm of Cisco. "While there are tremendous opportunities for our business and we are moving the resources to capitalize on them, there is also a significant risk," Chambers said. "This is the technology industry and change is constant and accelerating."

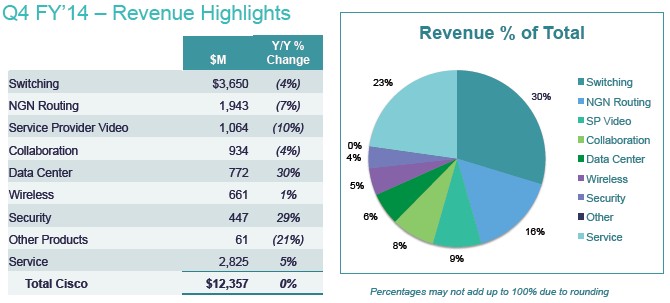

It is not hard to see where the job cuts are going to come from, looking at the revenue distribution for the quarter:

Cisco's switching business fell 4 percent to $3.65 billion, and Chambers said that it was being affected by the transition from its high-end Nexus 7000 core switches to the Nexus 9000s. The Nexus 9000s made their debut back in November and they have a different twist on software-defined networking that uses a combination of software and ASICs to abstract switching at the application level and, importantly, ties customers into Cisco's switching. This approach, called Application Centric Infrastructure, will have hooks into hypervisors and other SDN controllers, but the intent is clearly to preserve an all-Cisco stack wherever possible. Cisco has tripled the number of customers testing the Nexus 9000 to 580 in the past three months, which Chambers said was strong momentum, and it has 60 who are paying customers for the machines in the financial services, high tech, cloud, and hosting industries. In routing, the ASR 9000 line had double-digit growth, but other areas clearly had declines.

The datacenter business, which includes the UCS systems and related Nexus switches, continued to be a bright spot for Cisco in terms of revenue growth. Sales were up 30 percent to $772 million in the quarter. Chambers said that revenues derived from existing customers coming back for more UCS iron grew 49 percent year-on-year in the final quarter of its fiscal 2014, and added that the company now has 36,500 unique UCS customers. Perhaps more significantly, the UCS platform has gained market share for 18 straight quarters and based on preliminary figures for the second quarter of calendar 2014 that Cisco has seen (but which not have been announced yet), the company's share of the blade server market in the United States will hit 41 percent in calendar Q2, six points above the nearest competitor (which has to be either Dell or Hewlett-Packard). "Currently we have the number two position worldwide, and I expect us to close to the number one position if we execute the way I believe we can," Chambers said.

The UCS business by itself is now at a $3 billion annual run rate, driven by the VCE partnership between EMC, VMware and Cisco and the FlexPod partnership between Cisco and NetApp. At current growth rates, Cisco should probably settle into a business that is somewhere between $4 billion and $5 billion a year, which is as large as any single platform that any other incumbent server maker has built and maintained in the past two decades.

Chambers added that the UCS line would be upgraded in the fall, and he is no doubt referring to the impending launch of the "Haswell" Xeon E5-2600 v3 processors from Intel, which are widely expected to come out at Intel Developer Forum in about a month.