Enterprises Gravitate To Amazon’s Cloud

If there is a consistent message coming out of Amazon Web Services from its re:Invent conference in Las Vegas this week, it is that enterprise adoption of Amazon’s public cloud is on the rise. Private and public organizations are moving from dabbling in the cloud to deploying a large chunk of their mission critical applications there, and in some cases they are making a commitment to deploy all of their applications in the AWS public cloud.

The public cloud is not just for startups anymore, although it is probably a safe bet that startups plus programmers buying dark IT on the AWS cloud account for the majority of the 1 million customers that Andy Jassy, senior vice president in charge of the cloud at the retailing giant, confirmed that AWS now has. EnterpriseTech pressed Jassy to after his opening keynote to provide some kind of metric for the growth in the customer base and to provide a sense of how many customers are established enterprises and whether or not this enterprise base is growing faster than the customer base at large or the other capacity usage metrics that Amazon sometimes reveals about his cloud. In typical Amazon fashion, Jassy said that the numbers he had disclosed during the keynote were all he was going to reveal. But he did offer some qualification.

“I can tell you that our customer growth is quite substantial, and not surprisingly, our enterprise growth is quite substantial,” Jassy explained to EnterpriseTech. “It is substantial on the enterprise side in terms of both the number of companies that are using AWS and particularly because enterprises and public sector agencies spend more on infrastructure than startups just because of the nature of the applications and how large their businesses are. Those businesses and their movement to AWS tends to be lumpy, and so what happens is not only do you spend a lot of time with enterprise partners so they are comfortable moving to the platform but once they start moving a number of applications to the platform with a migration plan that varies from two to four years, depending on who they are. Once they move some applications in, then they open the floodgates and move pretty quickly. So the acceleration in the number of enterprises and the business from enterprises is pretty dramatic.”

To give a sense of the growth of the AWS public cloud, Amazon used to trot out statistics a few times a year that indicated how many objects were stored in its S3 object storage, but it no longer does this since it has created features that let customers automatically kill off S3 files when they get stale. (The customer sets when something gets deleted, not Amazon.) So the compares to old file counts is not exactly fair. But suffice it to say if the deletions were not too steep, then there should be something around 5 trillion to 6 trillion objects in S3 worldwide, we estimate, and it could be as high as 7 trillion or 8 trillion.

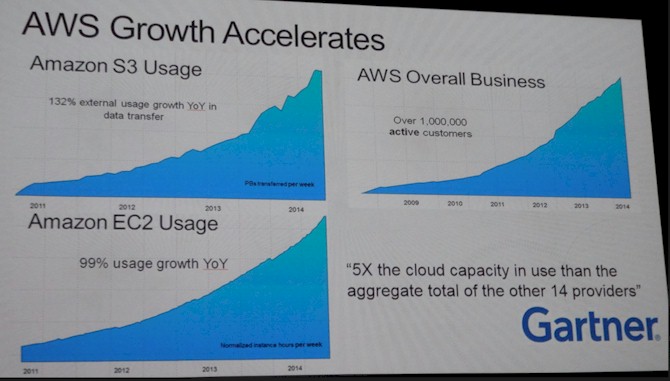

What Jassy did share were these statistics for AWS usage:

The upper left quadrant of this chart shows the growth in data transfers into and out of the S3 object storage service from what looks like late 2010 through the middle of 2014 or so. (The X axis is a bit vague, and Amazon did not give a scale for the Y axis at all, but did say it was measured in petabytes per week.) But it did say that year-on-year growth in traffic into and out of the S3 service had grown 132 percent between the current period in 2014 and the year-ago period. This traffic excluded any S3 traffic for the Amazon retail business, Jassy added – as if that were not more than a few teaspoons in a bucket anyway.

In the lower left quadrant of that chart, Jassy showed off some EC2 compute cloud statistics, specifically for normalized instance hours per week. There is a very interesting pattern in that data, if you look closely, which shows a regular saw tooth pattern superimposed on a gentle exponential curve. This probably says more about the normalization process across instance types (presumably dividing the raw computing in every kind of instance type by the performance of an average instance) than it does the actual EC2 traffic

The top right chart shows how AWS has grown its active customer accounts to over 1 million. It looks like it has been doubling every 18 months or so, more or less in line with what used to be Moore’s Law. Having more than 1 million customers for a commercial IT product of any kind is quite an accomplishment, but this is another drop in the bucket when you look at the $1.7 trillion that is spent on IT hardware, software, and services every year and the many tens of millions of companies that are using something other than a PC to run themselves. That said, Oracle has 440,000 customers and, before it sold of the System x division to Lenovo, IBM had about 500,000 customers. It is tough to break half a million and hold it in the enterprise.

The lower right quadrant is just a reminder that Gartner estimates that Amazon Web Services has about five times the server capacity as the fourteen next larger public cloud providers all put together. This is a staggering lead, but Amazon Web Services did have first mover advantage for several years on this utility computing approach when it launched in March 2006. This is an astounding lead, but Amazon is a cut-throat online retailer that rarely makes a profit and does not have the kind of deep pockets that rivals Google and Microsoft have.

“I don’t view that as a differentiator,” Jassy said during the question and answer session, dismissing the many, many billions of dollars that Google, Microsoft, and now IBM SoftLayer are pouring into their public cloud efforts. “If you look at the amount of functionality, the amount of services, the number of features in those services, we have a lot more functionality in our platform than any other provider. We are highly confident inside of Amazon that we are going to be able to fund this business to its potential. We continue to believe that AWS has the potential to be the largest part of Amazon, which is saying something given that our retail business is a $70 billion business. So we are very confident that we are going to be able to fund this business the way it deserves and the way that we have, and we are quite pleased with its progress.”

And well it should be. If you look at the most recent annual financials for the world’s largest IT companies, Salesforce.com is growing revenues at 38 percent, Microsoft at 25 percent, Google at 20 percent, VMware at 18 percent, and EMC at 9 percent. SAP, Oracle, and Hewlett-Packard eke out a tiny point or three or five of growth, Teradata and Cisco Systems are flat, and Symantec, NetApp, CA, CSC, and IBM are in the red. But Amazon Web Services is growing sales at more than 40 percent, says Jassy. How much more, and what those revenues are, he did not say. At some point, AWS will become material enough to have it separated out as a line item in Amazon’s financials, but AWS is probably running at a $4 billion run rate for its infrastructure and platform cloud services here in the fall of 2014.

Because reach and volume mean everything in a retail business, AWS wants to stretch it regions of service and its private network to link them around the globe. Amazon currently has 11 regions where its services emanate from, which have 28 unique availability zones and multiple mega-datacenters per zone.

“In the fullness of time, I believe that we will have a region in every large country,” Jassy said when asked about the company’s expansion plans. “We have a slightly different philosophy than some of the other providers. Some of those providers like to launch a datacenter and call it a region. And what we have found, given the number of customers who are running their real applications on top of us is that need high availability you want to build that applications across multiple datacenters and availability zones. So we tend to pick regions where we know we are going to build multiple datacenters right from the get-go.”

Helping in its enterprise efforts are thousands of system integrators, including old school IT giants like Accenture, Booz Allen Hamilton, Wipro, Capgemini, and CSC, who act like a systems reseller channel as much as a consultancy, plus a slew of tiny upstarts that have focused in AWS from the beginning. Jassy said that there were over 3,400 academic institutions who were running their applications on AWS, and added that the AWS Marketplace catalog now has over 1,900 products in 23 categories and that since it was started a little more than a year ago, over 70 million instance-hours on EC2 have come from applications acquired through this online app store for AWS. Jassy threw up the requisite foil showing enterprise customers who deploy mission-critical apps to AWS, and Intuit was trotted out on stage as the latest in a line of companies that have decided to use AWS exclusively as their IT platform, with a plan to get rid of its own iron and datacenters entirely.

There is not, as yet, a consistent pattern for enterprise adoption of the AWS cloud, but Jassy offered some generalities. The first wave of enterprises moved their application development and testing operations to the public cloud, and in some cases, they also developed some greenfield applications that ran out in the cloud and stayed there rather than being brought back down into the glass house. These greenfield applications include the supply chain management software that Boeing created for itself and put out on AWS, the healthcare patient monitoring software developed by Siemens to resell to doctor’s offices and clinics, and the StatCast feature for Major League Baseball that adds real-time performance analytics to players during games, just to name three. The second wave of enterprise applications to get to AWS are usually web sites and digital transformation of the business, and there is often an analytics component to it. Unilever, the giant Dutch manufacturer, has moved 1,700 sites dedicated to its huge product line to AWS, and the Financial Times is moving all of the analytics as well as its publication to AWS. Then finally, there are companies that have legacy applications, often with lots of dependencies, sometimes on vintage operating systems, databases, languages, and middleware, and often not easily moved to the cloud. As for those companies going “all in” for AWS, Jassy said that it is “a trend that is accelerating at a very high rate.”

To entice enterprise customers even more, AWS rolled out some application development tools based on Amazon’s internal “Apollo” code control system as well as a new souped-up version of the MySQL database that is re-architected for cloud systems and that has been in development for the past three years.

The Apollo development tool is being commercialized as a service called CodeDeploy, and in a move of enlightened self-interest, as it becomes available today it is also available for free. (Jassy says that when people leave Amazon, the one thing they miss is Apollo. This is akin to Google’s Borg and Omega cluster management systems, which techies say they miss when they leave the search engine giant.) Companion services called CodeCommit (for source code management) and CodePipeline (for continuous integration and application deployment).

The new version of MySQL is called Aurora, and it is born out of the frustration with the scalability and performance limits of the MySQL database and the very high price that enterprises pay for high-end relational databases. Jassy said that the Aurora service would be a “commercial-grade database at an open source price,” which is about one-tenth of the cost of a relational database from Oracle, IBM, or Microsoft. Aurora can handle 6 million insertions per minute and 30 million selects per minute, and will offer about 5X the performance of running MySQL on an EC2 compute instance with eight local SSDs or 5X the largest MySQL instance on the current Relational Database Service (RDS) database platform service on AWS. We will drill down into the Aurora database separately.