Lenovo, Juniper Eye China Datacenters With Server Partnership

As it seeks to boost global demand for servers, especially in the nascent Asian market, Lenovo announced a "global strategic partnership" this week with networking specialist Juniper Networks aimed at the next generation of hyper-converged datacenters.

Lenovo (HKSE:992), which is attempting to expand server demand across Asia, also said the partnership would seek to "develop joint go-to-market plans and a tailor-made resell model to address unique localization requirements in China"

The partners said Wednesday (March 9) they would leverage each other's x86-based servers and network switches to augment their converged infrastructure and software-defined offerings. Lenovo said its customers would now be able to purchase Juniper (NYSE: JNPR) switches through the server vendor's sales channel.

"With the move to disaggregation of hardware and software in the datacenter, the two companies intend to bring open, flexible solutions to market, leveraging the ONIE (Open Network Install Environment) model," the partners noted in a statement.

The partners also said they expect to collaborate on ways to simplifying datacenter management and orchestration as a way of speeding provisioning of services. Collaboration would include combining Lenovo's datacenter management software with Juniper's software-defined networking tools.

Juniper Networks CEO Rami Rahim noted in a statement that the Asia-focused partnership would help it deliver a "full-stack" solution to private cloud as well as hyper-scale enterprises.

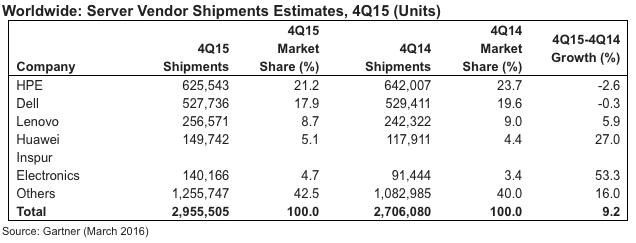

Lenovo ranked third in worldwide server shipments during the fourth quarter of 2015 behind leaders Hewlett Packard Enterprise (NYSE: HPE) and Dell, according to estimates released this week by market researcher Gartner Inc. (NYSE: IT). HPE, Dell and IBM (NYSE: IBM) also ranked ahead of Lenovo based on quarterly server vendor revenues, Gartner reported.

"With HPE, Dell, IBM and Lenovo all going through organizational changes, 2016 will decide which companies have made the right choices to drive their server businesses forward," noted Adrian O'Connell, a Gartner research director.

"With HPE, Dell, IBM and Lenovo all going through organizational changes, 2016 will decide which companies have made the right choices to drive their server businesses forward," noted Adrian O'Connell, a Gartner research director.

The market analyst said Intel x86 servers remain the dominant platform in datacenters, and Lenovo trumpeted a recent survey that gave its System x servers a "five nines" reliability rating, or 99.999 percent availability.

While Gartner said 2015 server shipments grew by nearly 10 percent, there is pressure on vendors like Lenovo to expand the Asian server market. According to Gartner, "the outlook for 2016 suggests that modest growth will continue in the server space on the whole with some constraint being felt from current economic and currency exchange issues in some regions."

An economic slowdown in China could also slow server demand. Meanwhile, Lenovo also faces stiff competition in Asia from Chinese networking and telecommunication equipment giant Huawei (SHE: 002502).

Lenovo Group executives acknowledged in October 2014 when they acquired IBM's x86 server business for $2.1 billion that they had their work cut out for them expanding the plateauing global server market. "We’re going to attack the marketplace," pledged Gerry Smith, executive vice president of the Lenovo Group. Smith acknowledged at the time that x86 server revenues have been "incremental" and "we do need to grow the marketplace."

The partnership with Juniper Networks appears to be another attempt to differentiate Lenovo's server offerings from larger U.S. rivals as well as Chinese upstarts.

Related

George Leopold has written about science and technology for more than 30 years, focusing on electronics and aerospace technology. He previously served as executive editor of Electronic Engineering Times. Leopold is the author of "Calculated Risk: The Supersonic Life and Times of Gus Grissom" (Purdue University Press, 2016).