For IBM/OpenPOWER: Success in 2017 = (Volume) Sales

(majestic b/Shutterstock)

To a large degree IBM and the OpenPOWER Foundation have done what they said they would – assembling a substantial and growing ecosystem and bringing Power-based products to market, all in about three years. Now, says Ken King, general manager, OpenPOWER, for IBM Systems Group, it’s time for all that organizational and technology rubber to hit the road and be converted into volume sales. That’s a tall, but very doable order, he argues.

IBM’s broad ambition, of course, is to make a big dent in Intel’s ironclad grasp of the x86 server landscape. “This year is about scale. We’re [IBM/OpenPOWER] only going to be effective if we get to 10-15-20 percent of the Linux socket market. Being at one or two percent won’t [do it],” says King. In a wide ranging conversation with HPCwire, King and Brad McCredie, IBM Fellow with responsibility for technology oversight of IBM Power Systems, discussed what’s been accomplished and what remains to be done to make IBM/OpenPOWER successful. King also shares some interesting insights on China market dynamics.

There’s no shortage of doubters. Taking on Intel is not for the faint hearted. IBM has perhaps sounded a strident note around the Power initiative in past years. As 2017 gets rolling King’s comments seem tempered by the tremendous efforts required so far. Make no mistake, IBM remains very confident, suggests King, but also clear-eyed about the challenges and encouraged by how much has been accomplished.

Here a very brief sampling of important IBM/OpenPOWER achievements so far:

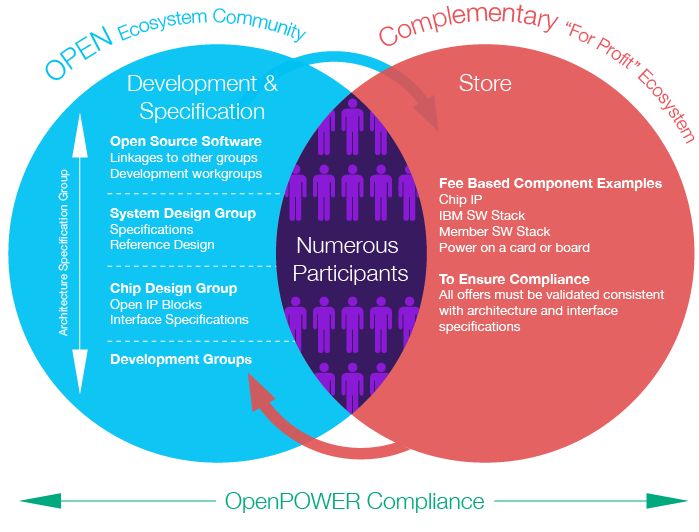

- OpenPOWER Membership has grown to 280-plus since its incorporation in December 2013 by signature founders IBM, NVIDIA, Mellanox, Google, and Tyan. Basically all elements of the IT technology supplier landscape (accelerator chips, networking, storage, software, etc.) are represented. Says King, “We don’t even think about how many members there are anymore.” There’s enough.

- The Power8 and Power8+ (NVLink) processors are out and in products. CAPI (Coherent Accelerator Processor Interface technology) for Power8 is out and work on OpenCAPI, launched in October 2016, is well underway – “It’s an entirely new open standard that has a unique physical and protocol layers. The one thing that we did was preserve the APIs the accelerator sees,” says McCredie.

- Power-based Products. In September IBM launched three new Power8/8+ servers including Minsky – the first commercial product with NVIDIA’s Pascal P100 GPU. Around ten Power-based systems from OpenPOWER partners (including from HPC stalwart Supermicro) were announced or launched at SC16. IBM launched PowerAI bundling of Minsky optimized for deep learning and intended to make DL adoption in the enterprise easier – King says more “packaged” solutions (finance, manufacturing, etc) are in development.

- Hyperscale Wins. Google (and Rackspace) announced in the spring plans for a Power9-based server supporting OCP. More recently Tencent – China largest Internet portal – announced plans to include Power-based systems in its mix. The market is still watching to see how quickly these announcements turn into real offerings for hyperscale customers and sales for IBM/OpenPOWER. IBM’s own cloud may be seen as a competitor though it’s unclear how much effect on OpenPOWER adoption it will have.

- Developer Clouds. IBM launched Supervessel, its Power-based cloud development platform, in Europe and China last year. At SC16 Big Blue launched collaboration with HPC cloud specialist Nimbix which has put the PowerAI platform and associated developer tools in its cloud.

- Power8/9 Roadmap. As noted, the Power8+ chip implemented NVLink for GPU communications. Power9 is due in 2017 and is expected to support NVLink and PCIe4 and also leverage OpenCAPI. Unlike the Power8 chip launch, which was strictly an IBM affair, the Power9 debut (four initial versions) will be an OpenPOWER family affair, says King, with numerous partner contributions and implementation commitments announced together.

The stakes are clearly ratcheting up. It’s also probably worth repeating that accelerator-assisted computing, driven by innovations from diverse ecosystem partners, is the fundamental IBM/OpenPOWER vision. This contrasts, argues King, with centralized control over architectural advance as practiced by Intel. No doubt Intel sees it differently. In any case, the ‘decline’ of Moore’s Law and the rise of heterogeneous computing as the necessary route for advancing high performance (in science and the enterprise) is a core IBM/OpenPOWER value proposition.

Asked whether or not IBM is satisfied with the progress, King is surprisingly candid.

“There’s no one answer to that. There are multiple answers in my opinion. My bosses are, of course, going to say not fast enough to the monetization, right. That said, as we work with our partners, and some of our partners are very large partners that understand this market really well, and in a couple of cases when we’ve met with them and I express my concern about monetization not happening fast enough, their feedback as are you kidding. ‘What are your expecting? You are starting from ground zero for the most part and in two years look where this has come. It takes five years to really scale from a monetization perspective’,” says King.

Five years seems an eternity in the technology, yet many analysts agree that’s probably what it takes given Intel’s dominant position and the customer challenges in making a switch.

Addison Snell, CEO, Intersect360 Research, says, “IBM has all the right pieces in place for POWER, and now the challenge is that they actually have to make sales. IBM did announce some good wins in both HPC and hyperscale markets around SC16, and we’ll get our first look at how much the total volume picked up when we do our total market model over the next few months, and of course, in our annual HPC Site Census survey. Our 2016 Site Census survey didn’t pick up any significant number of new POWER-based installations, but that was before Minsky was available, and IBM could see things picking up from here.”

King recognizes the challenges.

“Just to finish the thought. On the deployment side, as I said earlier, you are seeing now a lot of significant growth. This year is scaling. The challenge we are working through is the switching cost. On existing workloads you’ve got clients already ingrained in their data datacenters with x86-optimized based solutions. We have to show significant performance advantage to justify the switching costs associated it with it. We as an ecosystem, not just IBM, that’s the hurdle we are working on clearing. We aren’t all the way there. If we were all the way there we would be at 20-30 percent market share of Linux on power.

“Where we’re succeeding is delivering innovations that are showing the necessary level of differentiation. It can’t be 1.1X TCO. It’s got to be 1.5X or 2.0X to justify, ‘OK, I am going to move to another platform. I am going to port my applications to another platform. I am going to optimize them on that.’ That’s the hurdle we’re working on clearing,” says King.

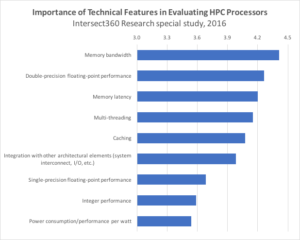

Citing a 2016 Intersect360 special study on processor architectures, Snell says “When HPC users rated the importance of technical features on a five-point scale, the most important characteristic was memory bandwidth, followed by double-precision performance and memory latency. These are areas in which the POWER architecture has an opportunity to gain. Furthermore, over half the HPC users responding indicated they would be using or evaluating Power/OpenPOWERover the next few years. If IBM can effectively sell the benefits of POWER to those evaluators, it stands a good chance to take a fair market share as a toehold in the HPC industry.”

King emphasizes a critical success element is this idea of building a complete ecosystem in which everyone benefits and the flexibility it offers. A good example, he says, is how the Tencent deal happened, starting with product design all the way to sales channel used.

“It was a system that was configured and manufactured by Supermicro at a cost point that made sense for Tencent and with that then becoming an IBM product. We then licensed or provided it as a product to reseller Inspur who then sold it to the customer because the customer’s procurement list only had Chinese companies,” says King.

“We couldn’t do that in the old model. The OpenPOWER model creates tons of flexibility for us through our partnerships. Now Inspur has decided they will develop their own OpenPOWER systems, initially for the China market, and then more globally for the broader the market as part of seeing the progress and seeing the interest from hyperscale clientele.”

China, of course, is a tricky geography to sell into at the moment, full of promise and market growth opportunities, but also closely controlled. China has worked hard to develop and expand its technology prowess generally and supercomputer capability specifically (See HPCwire article, US, China Vie for Supercomputing Supremacy).

King declined to comment on what effects, if any, the change and in US administration will trigger. President-elect Trump’s overture to Taiwan and U.S. border tax talk seem likely to stir political and trade tensions. Currently, a big control point is China’s use of 'local, secure, indigenous, and controllable technology' rules. “The more that tightens up the harder it is for multinationals. The more the expectation is for the multi-nationals to provide their intellectual property to China. You got to find the balance,” says King.

“The positive for us is it creates a very interesting door opener for Power, and ARM as well and alternative technologies. They are testing everything. But you have to be careful. Every major player, chip providers etc, is in China and everyone In China is trying to be the partner that’s got that one alternative. If we’re partnering with one company, than somebody else is going to partner with AMD, and somebody with ARM. China will continue to be a battleground for the next few years and I don’t know when or how it will end,” says King.

Leaving aside extended discussion of IBM’s multi-prong deep learning strategy as the wave of the future – that was the common theme among many technology suppliers at SC16 – it seems clear attacking the Linux market means a heavy emphasis on the wider enterprise. The convergence of “HPC and HPDA” is providing more opportunity for accelerated analytics says King noting that one large retailer has deployed a Power system with a GPU-accelerated database application. “They will probably allow us to talk about them next year once they have got some numbers and results,” he says.

IBM announced earlier its partnership with Kinetica which describes its platform as “a distributed, in-memory database accelerated by GPUs that can simultaneously ingest, analyze, and visualize streaming data for truly real-time actionable intelligence. Kinetica leverages the power of many core devices (such as GPUs) to deliver results orders of magnitude faster than traditional databases on a fraction of the hardware” IBM says it will work accelerated DB vendors “as we see fit”.

IBM’s PowerAI solution (Minsky) has already been optimized for a number of the machine learning/deep learning frameworks – Theano, Caffee and Torch – with more expected. But don’t mistake the obvious emphasis on penetration of the enterprise as a lack of interest or commitment in the Top500 and leadership class machines, says King.

“We are heavily invested and focused in helping down the path the exascale. So CORAL was a first step. There are other projects I can’t talk about (apex) I can't talk about now,” King says adding “We wouldn’t have won that in our traditional Power environment. It was the open architecture. It was the data centric computing model. It was the partnership with NIVIDIA and Mellanox. All of that enabled us to win it. That continues to be a strategy that we think that those kinds of agencies find very attractive.”

All netted down, the table is set for success, say King and McCredie. Power-based products, technology innovations, channels, (a few) signature customers, expanding ecosystem, and – not least – a philosophy that puts a premium on independently-driven innovation by partners are all present.

IBM’s fire to succeed is undiminished they insist, though the rhetoric seems a little less strident. What’s needed now are sales. One more year seems perhaps too ambitious to turn that tide, but enough to provide a strong indicator.