Intel Reportedly in $6B Bid for Mellanox

The latest rumors and reports around an acquisition of Mellanox focus on Intel, which has reportedly offered a $6 billion bid for the high performance interconnect company, according to Israeli publication Calcalist, a potential deal that industry analysts say could profoundly impact Intel's high performance interconnect strategies for both systems and storage.

Mellanox stock initially shot up nearly 15 percent based on the reports (shares are up 6 percent as of this writing) – a $6 billion bid would be a 35 percent premium over its Tuesday closing stock price.

Mellanox InfiniBand and Ethernet interconnects are used in more than half of the world's publicly-listed fastest computers. The company will announce fourth quarter 2018 financial results today after market closing.

The Israeli-based company, which has approximately 3,000 employees, was founded in 1999 by former Intel and Galileo Technology executives. Early this month, Mellanox announced the hiring of Doug Ahrens, formerly of Intel and of GlobalLogic (acquired last May for more than $2 billion), as SVP/CFO. Observers noted that new financial chiefs are sometimes hired to prepare a company for sale.

The Intel-Mellanox reports have been met with skepticism from Susquehanna Financial Group, according to a notice from Streetaccount picked up by SeekingAlpha, which cites “lack of regulatory scrutiny” and Intel's seven-month-long absence of a permanent CEO.

An interesting element of the possible acquisition deal is the fate of Intel’s Omni-Path Architecture (OPA), which the company has touted for several years as its high performance interconnect for HPC and exascale supercomputing. OPA development has been driven by a group of engineers originally at Cray who came to Intel as part of an April 2012 acquisition by Intel of Cray interconnect IP. Cray, meanwhile, has since developed its Slingshot high-speed interconnect technology, scheduled for launch later this year as part of Cray’s next-gen “Shasta” supercomputing architecture, announced last October.

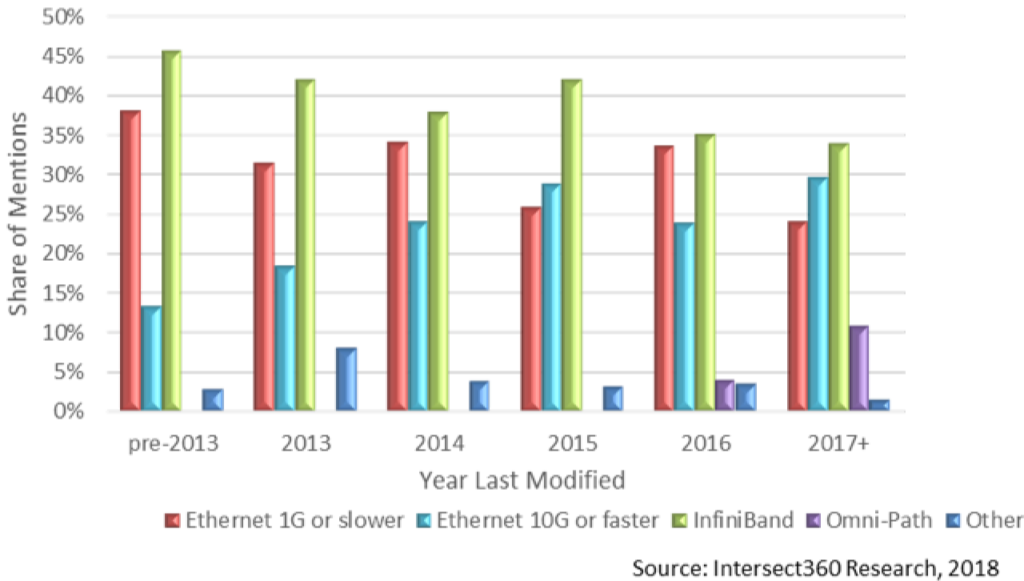

HPC industry analyst Addison Snell, CEO of Intersect360 Research, told us “Intel’s proposed acquisition is particularly interesting for high-performance markets, such as HPC, AI, and hyperscale. Mellanox is the de facto sole provider of InfiniBand, which is still the leading system interconnect for HPC systems, although it has declined slightly from over 40 percent share of surveyed systems five years ago to just over one-third today.”

Meanwhile, he said, Omni-Path appeared as a system interconnect in only 11 percent of surveyed HPC systems installed since the beginning of 2017. “This is progress, but it is probably short of what Intel hoped for in the market.”

Both Snell and Steve McDowell, senior analyst, storage and converged systems at Moor Insights & Strategy, said acquisition of Mellanox could have major impact on Intel’s storage strategy.

“One strong possibility is that Intel is interested in the abilities of InfiniBand as a storage interconnect,” Snell said. “InfiniBand represents 36 percent of storage interconnects among surveyed HPC sites, compared to only 2 percent for OmniPath. InfiniBand could be a key piece if Intel wishes to pursue a strategy of integrated, high-performance fabrics for both systems and storage.”

McDowell, who called the potential acquisition “strong…from a number of perspectives,” said “the deal certainly helps Intel’s networking business, but is also a huge potential boost to its storage business. Ethernet is shaping up to be the ultimate interconnect for NVMe-over-Fabric, which is the next generation storage connection to replace traditional SAN and iSCSI in the datacenter. The other evolving interconnect for NVMe-o-F is Infiniband. Mellanox brings both to the table, which will give Intel a strong position as these technologies rapidly evolve in the datacenter over the next two-five years. Intel has been making good in-roads in bringing its storage technology to market. Leveraging Mellanox IP as part of those efforts will bridge nicely with the broader Intel Data Center Group.”

Mellanox acquisition rumors have circulated for months. In early January, a report originating from Israeli technology publication TheMarker identified Microsoft, a major Mellanox customer, targeting Mellanox “as a way to strengthen its services in cloud computing as it competes with the likes of Amazon and Google.” In addition, London-based DatacenterDynamics reported that FPGA chip maker Xilinx, along with Intel and Broadcom, also could be interested in acquiring the Mellanox. In November, CNBC reported that Xilinx was working with Barclays on a purchase priced at $100/share, or about $5 billion.

Rumors of a Mellanox sale extend to at least November 2017, when the Wall Street Journal reported that activist investor Starboard Value acquired a 10.7 percent stake in Mellanox and pressured the company to better its financial position and explore a potential sale.